On December 27, 2024, Suvretta Capital Management, LLC made a significant move by acquiring an additional 2,221,821 shares of Fulcrum Therapeutics Inc (FULC, Financial). This transaction increased the firm's total holdings in Fulcrum Therapeutics to 3,404,612 shares. The shares were acquired at a price of $4.79 each, reflecting a strategic decision by the firm to bolster its position in the biopharmaceutical sector. This acquisition represents a 0.34% impact on Suvretta Capital Management's portfolio, with Fulcrum Therapeutics now constituting 0.52% of the firm's total holdings.

About Suvretta Capital Management, LLC

Suvretta Capital Management, LLC is a prominent investment firm based in New York, NY. The firm is known for its focus on the healthcare and technology sectors, managing an equity value of $3.13 billion. Suvretta Capital's investment philosophy emphasizes identifying undervalued opportunities within these sectors. The firm's top holdings include companies such as Insmed Inc (INSM, Financial), Intra-Cellular Therapies Inc (ITCI, Financial), and Kura Oncology Inc (KURA, Financial), showcasing its strategic focus on innovative healthcare solutions.

Overview of Fulcrum Therapeutics Inc

Fulcrum Therapeutics Inc is a clinical-stage biopharmaceutical company based in the USA. The company is dedicated to developing therapies for genetically defined diseases. Its key programs include losmapimod, aimed at treating facioscapulohumeral muscular dystrophy (FSHD), and FTX-6058, designed to increase fetal hemoglobin expression for treating sickle cell disease and other hemoglobinopathies. As of the latest data, Fulcrum Therapeutics has a market capitalization of $265.381 million, with its stock priced at $4.92. Despite its innovative pipeline, the company currently operates at a loss, reflected by a PE percentage of 0.00.

Impact of the Transaction

The recent acquisition by Suvretta Capital Management has positioned Fulcrum Therapeutics as a notable component of the firm's portfolio, with a 6.30% holding ratio in the traded stock. This strategic move underscores the firm's confidence in Fulcrum's potential despite the challenges faced by the biopharmaceutical industry. The transaction's impact on Suvretta's portfolio is relatively modest at 0.34%, yet it signifies a calculated bet on the future success of Fulcrum's clinical programs.

Financial Metrics and Valuation

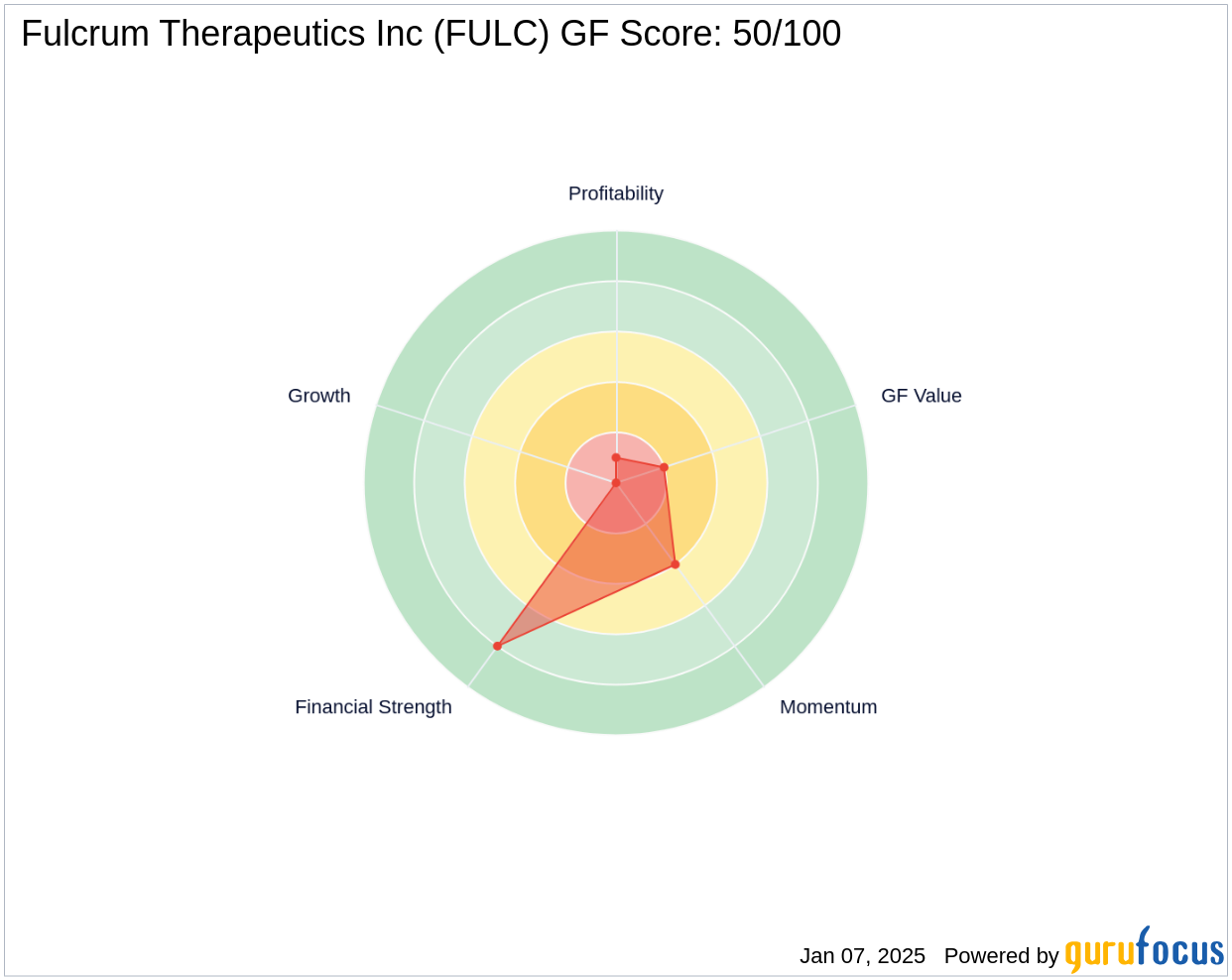

Fulcrum Therapeutics' financial metrics present a mixed picture. The company's [GF Valuation](https://www.gurufocus.com/term/gf-value/FULC) indicates a "Possible Value Trap, Think Twice" status, with a stock price to GF Value ratio of 0.12, suggesting potential undervaluation. However, the company's financial strength is challenged by a [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/FULC) of 1/10 and a [Growth Rank](https://www.gurufocus.com/term/rank-growth/FULC) of 0/10, reflecting difficulties in achieving sustainable growth and profitability.

Performance and Growth Indicators

Fulcrum Therapeutics has a [GF Score](https://www.gurufocus.com/term/gf-score/FULC) of 50/100, indicating poor future performance potential. The company's [Balance Sheet Rank](https://www.gurufocus.com/term/rank-balancesheet/FULC) is relatively strong at 8/10, but its profitability and growth ranks are low, highlighting challenges in these areas. Since the transaction, the stock has gained 2.71%, showing some positive momentum. However, the company's long-term performance remains uncertain, with a significant decline of 66.07% since its IPO.

Conclusion

Suvretta Capital Management's investment in Fulcrum Therapeutics reflects a strategic decision to capitalize on potential opportunities within the biopharmaceutical sector. While the current financial metrics and market conditions present certain risks, the firm's confidence in Fulcrum's innovative programs could yield significant rewards if the company's clinical developments prove successful. Investors should weigh these potential opportunities against the inherent risks associated with investing in clinical-stage biopharmaceutical companies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.