Insights into the Fund's Strategic Moves in Q4 2024

Hennessy Japan Small Cap Fund (Trades, Portfolio) recently submitted its N-PORT filing for the fourth quarter of 2024, revealing strategic investment decisions made during this period. Established on August 31, 2007, the Fund aims for long-term capital appreciation by investing at least 80% of its net assets in smaller Japanese companies. These companies are defined as those with market capitalizations in the bottom 15% of all Japanese companies. The Fund's investment strategy focuses on identifying good businesses with exceptional management, trading at attractive prices. The portfolio managers employ rigorous, on-site research to select stocks, emphasizing market growth potential, management quality, earnings quality, and balance sheet strength. The Fund seeks to capitalize on arbitrage opportunities between a company's fundamental value and its market price, maintaining a concentrated portfolio of the managers' best ideas.

Summary of New Buy

Hennessy Japan Small Cap Fund (Trades, Portfolio) added a total of two stocks to its portfolio during the fourth quarter of 2024:

- The most significant addition was Litalico Inc (TSE:7366, Financial), with 210,700 shares, accounting for 1.43% of the portfolio and a total value of ¥1,504,850 million.

- The second largest addition was Optex Group Co Ltd (TSE:6914, Financial), consisting of 15,600 shares, representing approximately 0.16% of the portfolio, with a total value of ¥165,920.

Key Position Increases

Hennessy Japan Small Cap Fund (Trades, Portfolio) also increased stakes in a total of six stocks, including:

- The most notable increase was in Kanamoto Co Ltd (TSE:9678, Financial), with an additional 32,600 shares, bringing the total to 93,300 shares. This adjustment represents a significant 53.71% increase in share count, a 0.56% impact on the current portfolio, with a total value of ¥1,686,230.

- The second largest increase was in Nissan Chemical Corp (TSE:4021, Financial), with an additional 12,000 shares, bringing the total to 54,800. This adjustment represents a significant 28.04% increase in share count, with a total value of ¥1,850,880.

Summary of Sold Out

Hennessy Japan Small Cap Fund (Trades, Portfolio) completely exited two holdings in the fourth quarter of 2024:

- Tsubakimoto Chain Co (TSE:6371, Financial): The Fund sold all 141,900 shares, resulting in a -1.78% impact on the portfolio.

- WingArc1st Inc (TSE:4432, Financial): The Fund liquidated all 62,500 shares, causing a -1.01% impact on the portfolio.

Key Position Reduces

Hennessy Japan Small Cap Fund (Trades, Portfolio) also reduced its position in four stocks. The most significant changes include:

- Reduced Nojima Co Ltd (TSE:7419, Financial) by 59,100 shares, resulting in a -60.8% decrease in shares and a -0.57% impact on the portfolio. The stock traded at an average price of ¥1,847.98 during the quarter and has returned 13.27% over the past three months and 32.68% year-to-date.

- Reduced Asia Pile Holdings Corp (TSE:5288, Financial) by 55,300 shares, resulting in a -15.23% reduction in shares and a -0.32% impact on the portfolio. The stock traded at an average price of ¥828.03 during the quarter and has returned -0.54% over the past three months and 24.33% year-to-date.

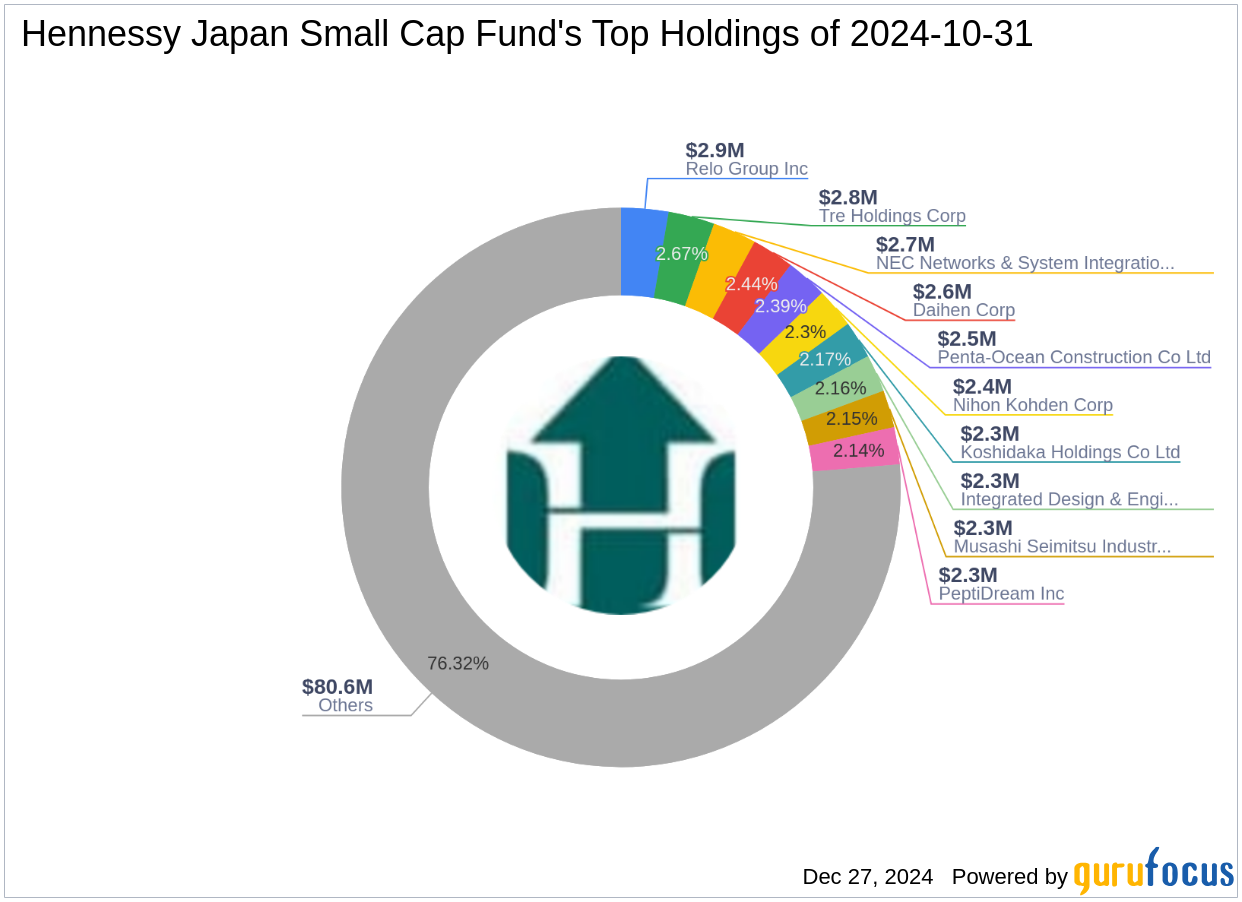

Portfolio Overview

As of the fourth quarter of 2024, Hennessy Japan Small Cap Fund (Trades, Portfolio)'s portfolio included 66 stocks. The top holdings were:

- 2.73% in Relo Group Inc (TSE:8876, Financial)

- 2.67% in Tre Holdings Corp (TSE:9247, Financial)

- 2.53% in NEC Networks & System Integration Corp (TSE:1973, Financial)

- 2.44% in Daihen Corp (TSE:6622, Financial)

- 2.39% in Penta-Ocean Construction Co Ltd (TSE:1893, Financial)

The holdings are mainly concentrated in 10 of the 11 industries: Industrials, Consumer Cyclical, Technology, Basic Materials, Healthcare, Consumer Defensive, Financial Services, Real Estate, Communication Services, and Utilities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.