On December 20, 2024, Carl Icahn (Trades, Portfolio), a prominent activist investor, executed a significant stock transaction involving CVR Partners LP. This transaction saw the addition of 11,589 shares at a price of $74.22 per share, increasing Icahn's total holdings in the company to 4,054,457 shares. This move reflects a 0.29% change in shareholding and impacts 0.01% of Icahn's extensive portfolio. The strategic acquisition underscores Icahn's continued interest in CVR Partners LP, a key player in the nitrogen fertilizer industry.

Understanding Carl Icahn (Trades, Portfolio)'s Investment Approach

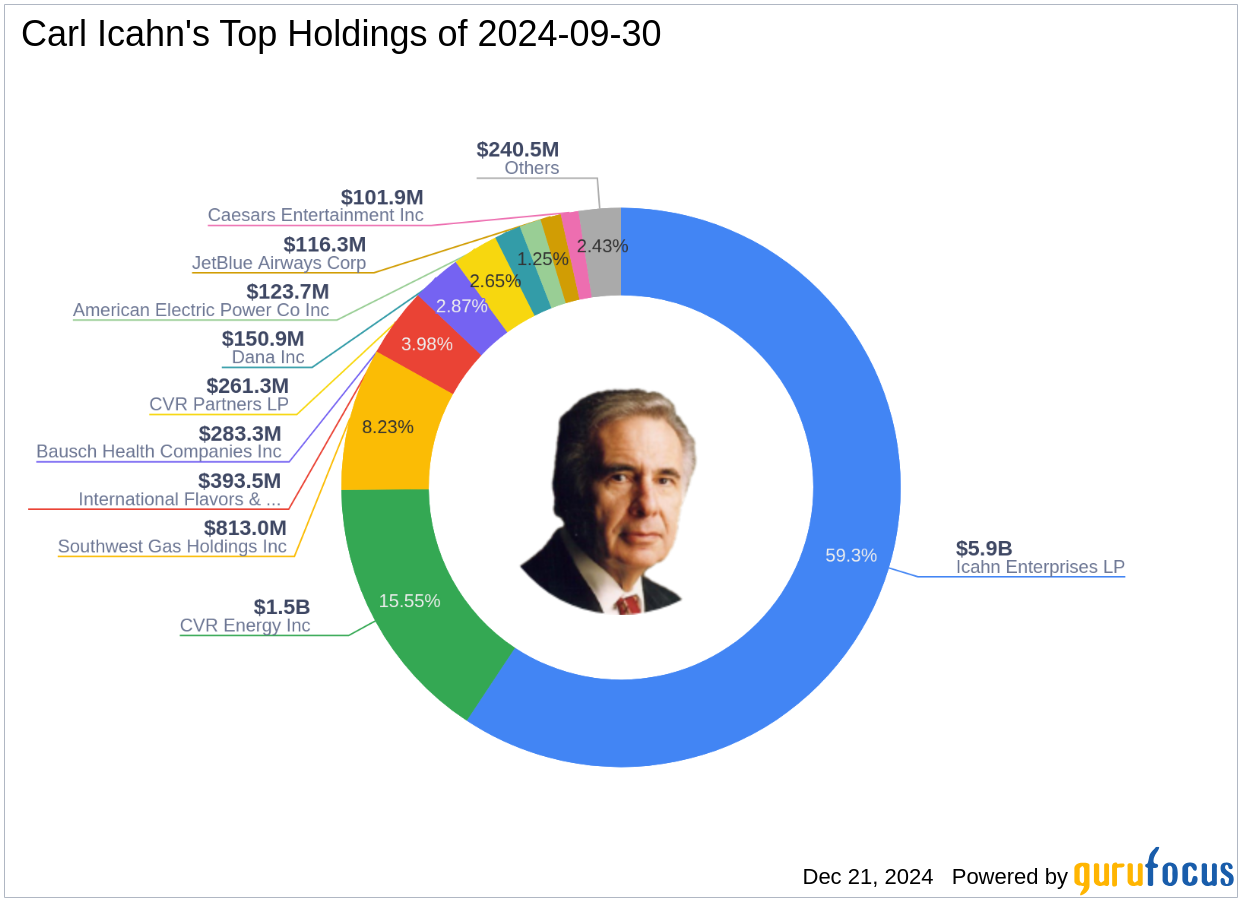

Carl Icahn (Trades, Portfolio) is renowned for taking substantial stakes in public companies and advocating for transformative changes. The firm employs a distinctive investment strategy, focusing on acquiring undervalued assets, often from distressed situations, and revitalizing them for future sale. Icahn's investment philosophy is rooted in contrarian thinking, targeting companies and industries that are out of favor. This approach has been instrumental in the firm's success, as evidenced by the diverse holdings in Icahn Capital Management's portfolio, which includes top holdings such as Icahn Enterprises LP, CVR Energy Inc, and International Flavors & Fragrances Inc.

Overview of CVR Partners LP

CVR Partners LP, trading under the symbol UAN, is a U.S.-based manufacturer and supplier of nitrogen fertilizer products. The company primarily markets Urea Ammonium Nitrate (UAN, Financial) and ammonia to industrial and agricultural customers. Its primary geographic markets include Kansas, Missouri, Nebraska, Iowa, Illinois, Colorado, and Texas. The company's product sales are heavily weighted toward UAN, making it a significant player in the agriculture industry. With a market capitalization of $784.373 million and a price-to-earnings ratio of 14.93, CVR Partners LP is currently considered fairly valued, with a GF Value of $70.81, slightly below the current price of $74.21.

Financial Metrics and Valuation

CVR Partners LP has demonstrated robust growth indicators, with an impressive operating margin growth of 83.10% and EBITDA growth of 93.10% over the past three years. Despite a year-to-date price increase of 9.33%, the stock has experienced a -58.77% change since its IPO. The company's GF Score of 77/100 suggests a likely average performance, while its Profitability Rank stands at 8/10, indicating strong profitability. The Financial Strength is moderate with a rank of 5/10, and the Altman Z score of 1.62 suggests some financial risk.

Portfolio and Sector Context

CVR Partners LP constitutes 3.05% of Icahn's portfolio and represents 38.36% of the holdings in this particular stock. The firm's portfolio is heavily weighted towards the energy and utilities sectors, aligning with the investment in CVR Partners LP. This strategic focus on energy and utilities reflects Icahn's confidence in these sectors' potential for growth and recovery, particularly in the context of global economic shifts and energy demands.

Conclusion and Implications for Investors

Carl Icahn (Trades, Portfolio)'s continued investment in CVR Partners LP signals a strong belief in the company's potential for recovery and growth. For value investors, the stock's current valuation and growth prospects present an intriguing opportunity, as indicated by Icahn's strategic addition. The transaction not only enhances Icahn's position in CVR Partners LP but also underscores the firm's commitment to investing in undervalued assets with significant upside potential. As the company continues to navigate the challenges and opportunities within the agriculture industry, investors may find value in monitoring its performance and strategic developments.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.