On November 25, 2024, Beryl Capital Management LLC (Trades, Portfolio) made a significant move by acquiring 4,500,000 shares of Brightcove Inc. This transaction was executed at a price of $4.32 per share, marking a strategic addition to the firm's portfolio. The acquisition represents a new holding for Beryl Capital Management LLC (Trades, Portfolio), with Brightcove Inc now accounting for 4.04% of the firm's portfolio. This move underscores the firm's interest in expanding its investments within the technology sector, particularly in companies offering cloud-based solutions.

About Beryl Capital Management LLC (Trades, Portfolio)

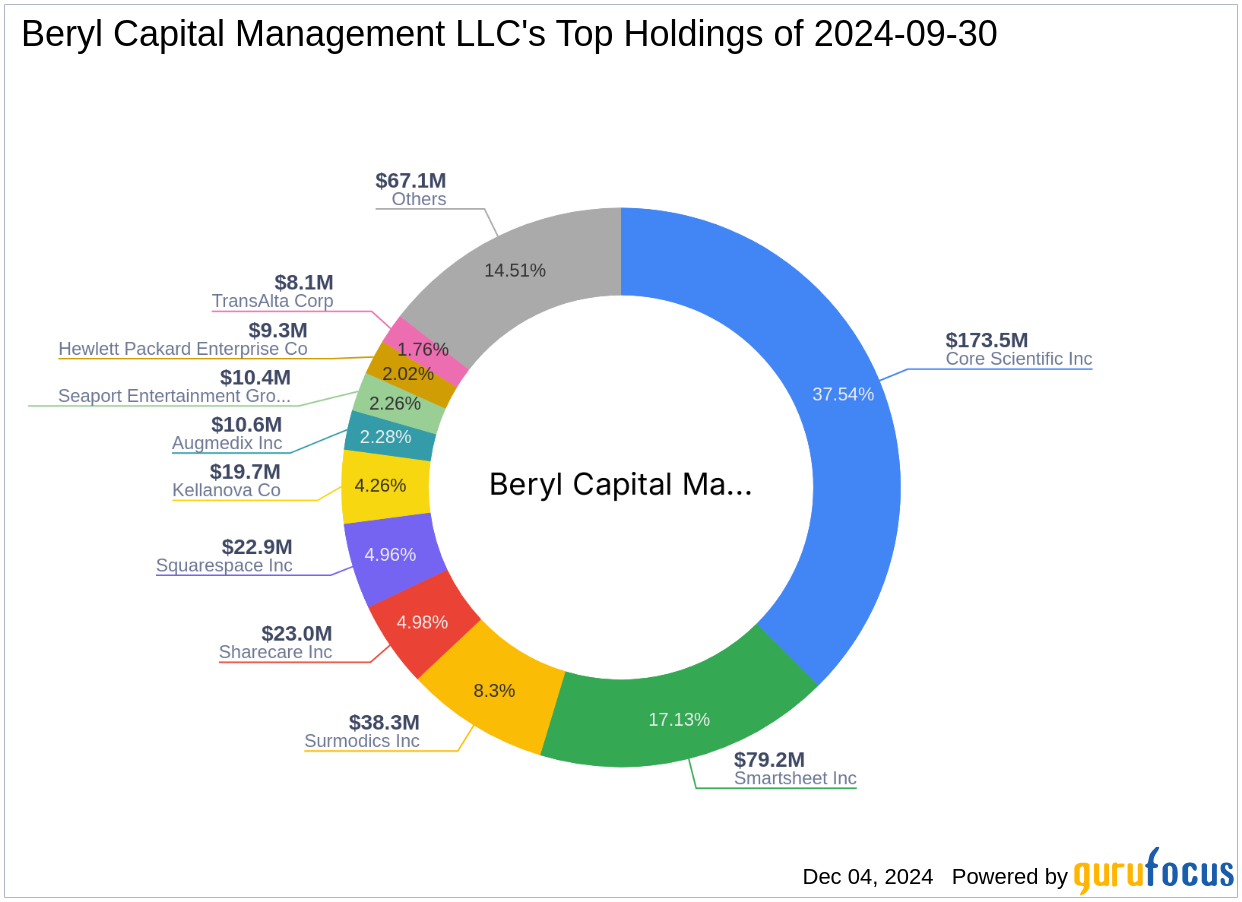

Beryl Capital Management LLC (Trades, Portfolio) is a well-regarded investment firm known for its strategic focus on the technology and healthcare sectors. With an equity value of $462 million, the firm manages a diverse portfolio consisting of 29 stocks. Some of its top holdings include Surmodics Inc (SRDX, Financial), Smartsheet Inc (SMAR, Financial), and Squarespace Inc (SQSP, Financial). The firm's investment philosophy emphasizes identifying growth opportunities within its preferred sectors, leveraging its expertise to maximize returns for its investors.

Introducing Brightcove Inc

Brightcove Inc is a prominent provider of cloud-based streaming technology and services. The company caters to a wide range of clients, including media companies, broadcasters, and digital publishers. Brightcove's flagship product, Video Cloud, enables customers to publish and distribute video content to internet-connected devices, generating revenue through a subscription-based model. With a current market capitalization of $193.368 million and a stock price of $4.28, Brightcove is positioned within the competitive software industry, targeting growth in North America and Asia.

Impact of the Transaction

The acquisition of Brightcove Inc shares by Beryl Capital Management LLC (Trades, Portfolio) has notable implications for the firm's portfolio. With this transaction, Brightcove now represents 4.04% of the firm's holdings, highlighting its strategic importance. Additionally, the new holding accounts for 9.97% of Beryl Capital Management LLC (Trades, Portfolio)'s total investments in Brightcove Inc, indicating a significant commitment to the company's potential growth and profitability.

Financial Metrics and Valuation

Brightcove Inc's financial health is reflected in its GF Score of 63/100, suggesting a modest potential for future performance. The company's balance sheet is ranked at 6/10, indicating moderate financial strength. Despite being modestly overvalued with a GF Value of $3.72 and a price-to-GF value ratio of 1.15, the stock's current price of $4.28 suggests a cautious approach for value investors.

Performance and Growth Prospects

Brightcove Inc has experienced a year-to-date price change of 71.89%, reflecting a strong performance in the market. However, the company faces growth challenges, with a 3-year revenue growth rate of -2.30% and an earnings growth rate of -130.00%. These figures highlight the need for strategic initiatives to drive future growth and profitability, particularly in a competitive industry landscape.

Market Position and Competitive Landscape

Within the software industry, Brightcove Inc holds a unique position as a provider of cloud-based streaming solutions. The company's ability to compete with other industry players will depend on its capacity to innovate and expand its market reach. As the demand for digital content continues to grow, Brightcove's focus on enhancing its product offerings and customer base will be crucial for sustaining its competitive edge.

Conclusion

Beryl Capital Management LLC (Trades, Portfolio)'s investment in Brightcove Inc represents a strategic decision to capitalize on the potential growth of cloud-based streaming technology. While the transaction presents opportunities for value investors, it also carries inherent risks associated with the company's current financial metrics and growth challenges. As Brightcove navigates its competitive landscape, the firm's ability to execute its strategic vision will be pivotal in determining the success of this investment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.