Overview of the Recent Transaction

On November 13, 2024, Greenlight Capital, under the leadership of David Einhorn (Trades, Portfolio), executed a significant transaction by purchasing an additional 869,110 shares of Green Brick Partners Inc (GRBK, Financial). This acquisition was made at a price of $69.86 per share, increasing the firm's total holdings in the company to 10,336,493 shares. This move not only reflects a 9.18% change in the firm's holdings but also impacts its portfolio by 2.46%, solidifying Green Brick Partners Inc as a top holding with a 29.31% portfolio position.

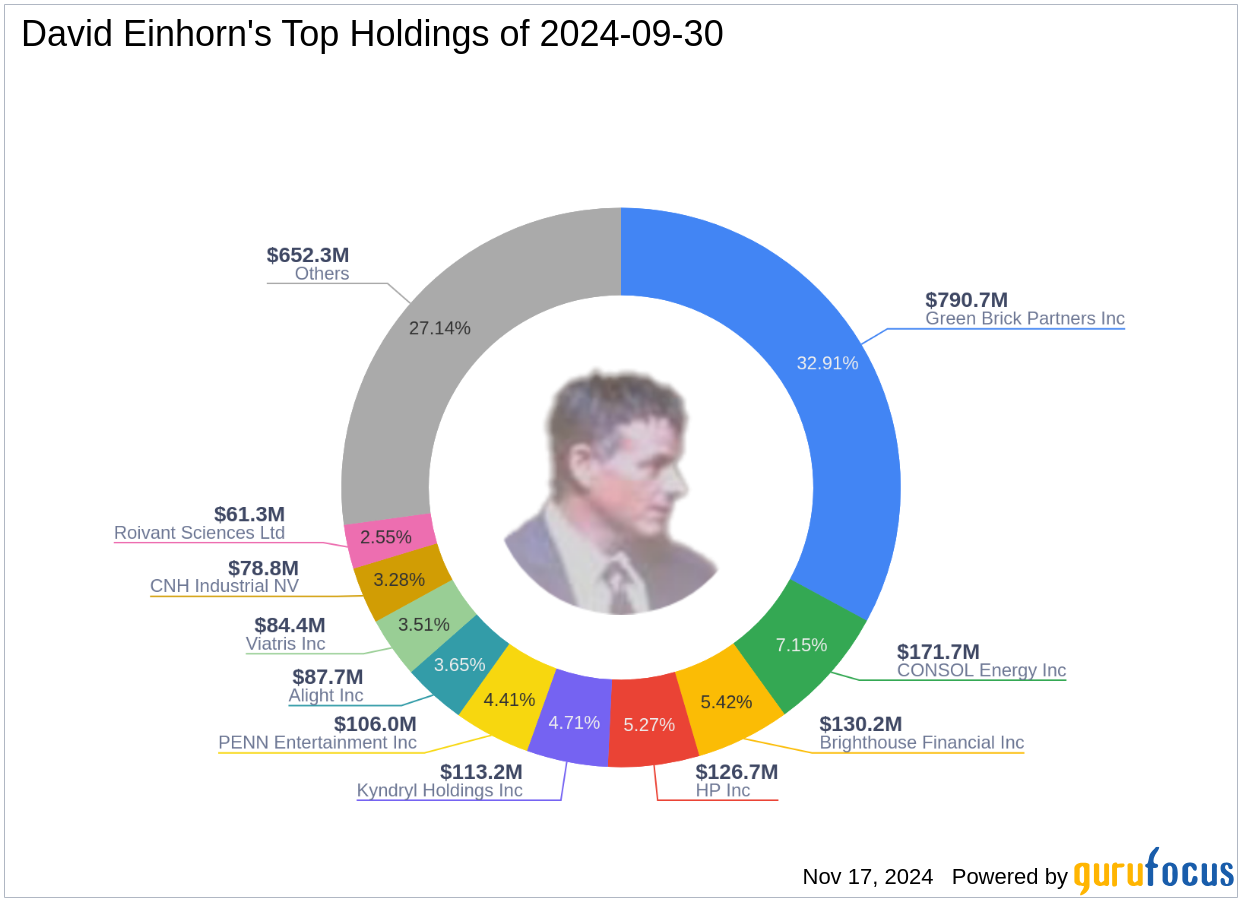

Profile of David Einhorn (Trades, Portfolio)

David Einhorn (Trades, Portfolio), president of Greenlight Capital, a New York-based hedge fund established in 1996, is renowned for a value-oriented investment strategy. The firm focuses on North American corporate debt offerings and equities, emphasizing intrinsic value to achieve consistent returns and safeguard capital. As an activist investor, Einhorn is known for influencing significant changes in the operations of the companies in which the firm invests. Currently, Greenlight Capital manages an equity portfolio worth approximately $2.4 billion, with top holdings in sectors such as Consumer Cyclical and Technology.

Introduction to Green Brick Partners Inc

Founded in 2007, Green Brick Partners Inc is a diversified homebuilding and land development company based in the USA. The company operates through segments like builder operations central, builder operations southeast, and land development, primarily in Texas. Green Brick not only engages in land acquisition and development but also offers financing solutions for construction and mortgage needs. With a market capitalization of $3.09 billion, the company has shown robust financial performance, reflected in its high profitability and growth ranks.

Analysis of the Trade's Impact

The recent acquisition by Greenlight Capital has increased its stake in Green Brick Partners Inc to 23.20% of the company's available shares, marking a significant influence on both the firm's portfolio and the market perception of Green Brick. This strategic move could signal strong confidence in the company's future growth and operational strategy, potentially influencing other investors' views and the company's stock market performance.

Market Performance and Valuation of Green Brick Partners Inc

Currently, Green Brick Partners Inc trades at $69.45, slightly below the purchase price but significantly above the GF Value of $52.81, indicating the stock is "Significantly Overvalued." The company's PE ratio stands at 9.01, with a GF Score of 91, suggesting high potential for future outperformance. The stock has experienced a year-to-date increase of 33.97%, despite a slight decline of 0.59% since the transaction date.

Sector Influence and Market Trends

The Consumer Cyclical and Technology sectors, where Greenlight Capital holds significant investments, continue to play a crucial role in the firm's strategy. The homebuilding and construction industry faces various challenges and opportunities, influenced by economic conditions, interest rates, and consumer trends, which could impact Green Brick's operational strategy and market performance.

Comparative Analysis with Other Major Investors

Other notable investors in Green Brick Partners Inc include HOTCHKIS & WILEY and Third Avenue Management (Trades, Portfolio), although Greenlight Capital remains the largest shareholder. This dominant position could provide Einhorn with leverage in influencing the company's strategic decisions and future direction.

Future Outlook and Strategic Considerations

The decision by Greenlight Capital to increase its stake in Green Brick Partners Inc may be driven by the firm's strong financial metrics, strategic market position, and growth potential in the homebuilding sector. Looking forward, the company's ability to maintain its growth trajectory and profitability will be crucial for sustaining investor confidence and achieving long-term value creation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.