Overview of Recent Transaction by GAGNON SECURITIES LLC (Trades, Portfolio)

On September 30, 2024, GAGNON SECURITIES LLC (Trades, Portfolio), a prominent investment firm, executed a significant transaction by acquiring 2,905,406 shares of Profound Medical Corp (PROF, Financial), a medical device company based in Canada. This move, marked as an addition to the firm's holdings, involved a trade price of $7.96 per share, reflecting a strategic investment decision by the firm. The transaction not only increased the firm's total holdings in PROF but also impacted its portfolio by 2.44%.

Insight into GAGNON SECURITIES LLC (Trades, Portfolio)

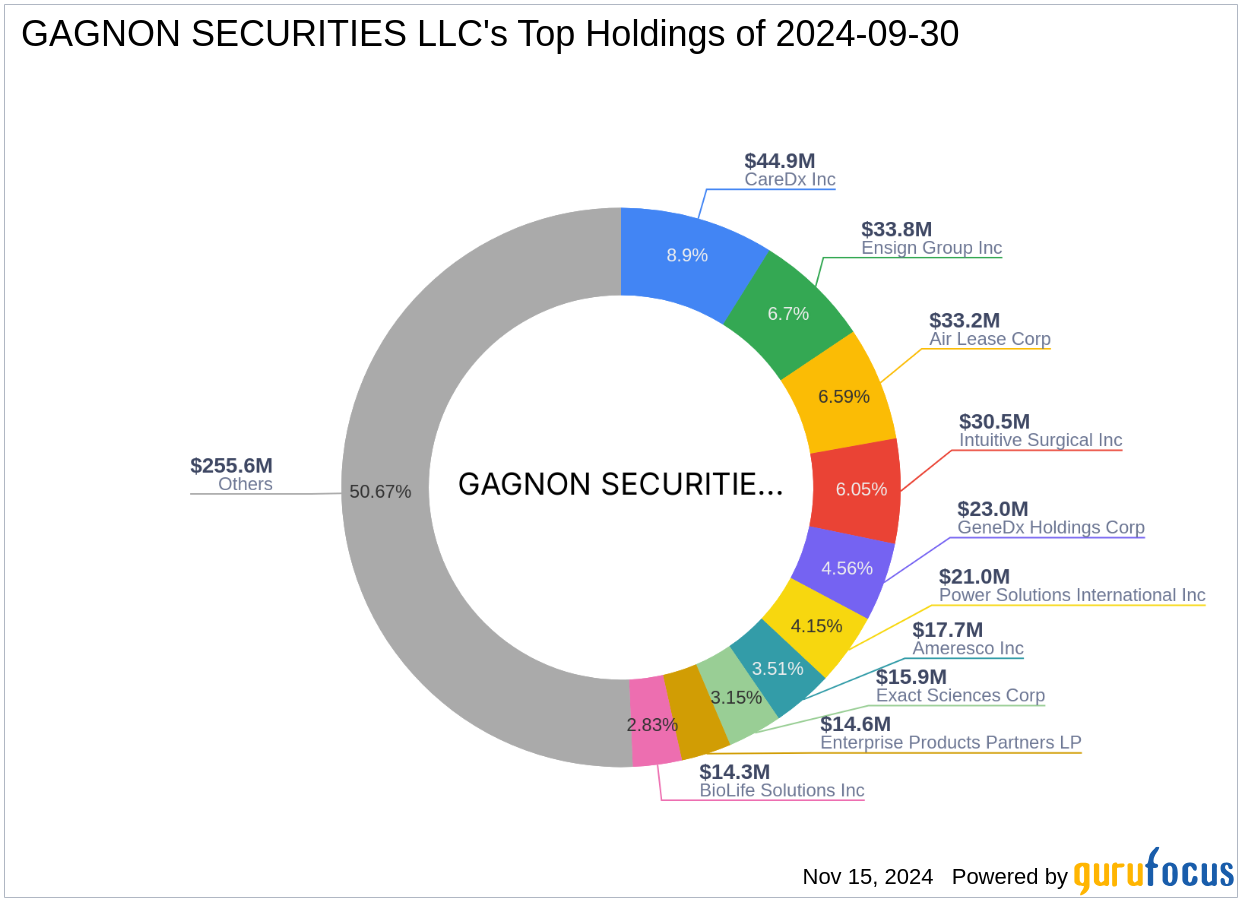

GAGNON SECURITIES LLC (Trades, Portfolio), headquartered at P.O. BOX 1370 AVENUE OF THE AMERICAS, NEW YORK, NY, is recognized for its expert market strategies and investment philosophy. With a portfolio equity of $504 million and investments across 102 stocks, the firm focuses predominantly on the healthcare and technology sectors. Some of its top holdings include CareDx Inc (CDNA, Financial), Ensign Group Inc (ENSG, Financial), and Intuitive Surgical Inc (ISRG, Financial). The firm's strategic acquisitions reflect its commitment to investing in high-potential sectors.

Profound Medical Corp: A Focus on Innovative Medical Devices

Profound Medical Corp specializes in the development and marketing of customizable, incision-free therapeutic systems for the ablation of diseased tissue. Its flagship product, the TULSA-PRO system, integrates real-time MRI and thermal ultrasound technologies. Founded on May 9, 2016, the company has a market capitalization of approximately $199.149 million and is listed under the symbol PROF.

Financial and Market Performance of Profound Medical Corp

Currently, PROF's stock price stands at $8.0114, modestly undervalued with a GF Value of $8.98. Despite a challenging financial performance with a PE Percentage of 0.00 indicating losses, the company holds a promising GF Score of 75/100, suggesting potential for future outperformance. The stock has seen a year-to-date increase of 0.77% but has declined by 21.38% since its IPO.

Impact of the Trade on GAGNON SECURITIES LLC (Trades, Portfolio)’s Portfolio

The recent acquisition of PROF shares significantly bolsters GAGNON SECURITIES LLC (Trades, Portfolio)'s position in the medical devices sector, with the firm now holding 11.80% of total shares in Profound Medical Corp. This strategic addition, representing 5.08% of the firm's portfolio, underscores its confidence in PROF's growth prospects and its alignment with the firm's investment strategy.

Strategic Alignment with GAGNON SECURITIES LLC (Trades, Portfolio)’s Investment Focus

Profound Medical Corp fits seamlessly into GAGNON SECURITIES LLC (Trades, Portfolio)’s investment strategy, which prioritizes healthcare and technology sectors. This acquisition aligns with the firm's approach to investing in innovative companies that have the potential to lead their respective industries through technological advancements.

Future Outlook for Profound Medical Corp

Despite current financial challenges, Profound Medical Corp's innovative medical solutions and strategic market positioning suggest a positive outlook. The company's focus on expanding its product offerings and penetrating new markets could drive future growth and profitability, aligning with GAGNON SECURITIES LLC (Trades, Portfolio)'s expectations for high-performance investments.

Conclusion

The acquisition of Profound Medical Corp shares by GAGNON SECURITIES LLC (Trades, Portfolio) is a strategic move that reflects the firm's confidence in PROF's future and its commitment to investing in sectors with substantial growth potential. This transaction not only enhances the firm's portfolio but also positions it to benefit from future advancements in the medical devices industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.