Insight into the Q3 2024 13F Filing Reveals Significant Adjustments and Market Trends

Caxton Associates (Trades, Portfolio), the renowned global macro hedge fund established by Bruce Kovner in 1983, has recently disclosed its 13F filing for the third quarter of 2024. Known for its strategy of capitalizing on macroeconomic trends across various asset classes, Caxton Associates (Trades, Portfolio) actively adjusts its holdings to optimize short-term market movements, with a noted preference for low-volatility sectors.

New Additions to the Portfolio

Caxton Associates (Trades, Portfolio) expanded its portfolio by adding 208 new stocks. Key acquisitions include:

- Boston Scientific Corp (BSX, Financial), purchasing 700,000 shares, making up 2.2% of the portfolio at a value of $58.66 million.

- PayPal Holdings Inc (PYPL, Financial), with 641,376 shares, representing 1.87% of the portfolio, valued at $50.05 million.

- Kellanova Co (K, Financial), acquiring 247,706 shares, accounting for 0.75% of the portfolio, totaling $19.99 million.

Significant Increases in Existing Positions

Among the stocks where Caxton Associates (Trades, Portfolio) increased its stakes, notable adjustments were made in:

- Tesla Inc (TSLA, Financial), with an additional 1,175,000 shares, bringing the total to 1,775,000 shares. This adjustment marks a 195.83% increase in share count and an 11.51% impact on the current portfolio, valued at $464.39 million.

- Amazon.com Inc (AMZN, Financial), adding 1,240,181 shares, resulting in a total of 1,533,783 shares. This represents a 422.4% increase in share count, with a total value of $285.79 million.

Complete Exits from Certain Holdings

In the third quarter of 2024, Caxton Associates (Trades, Portfolio) exited 161 positions, including:

- Micron Technology Inc (MU, Financial), selling all 1,300,000 shares, impacting the portfolio by -5.84%.

- Intel Corp (INTC, Financial), liquidating all 5,250,000 shares, with a -5.56% impact on the portfolio.

Reductions in Key Positions

Reductions were also prominent in Caxton Associates (Trades, Portfolio)' strategy, with significant cuts in:

- Citigroup Inc (C, Financial), reducing by 3,893,070 shares, a -98.5% decrease, impacting the portfolio by -8.44%. The stock traded at an average price of $61.84 during the quarter.

- Microsoft Corp (MSFT, Financial), cutting down by 283,488 shares, a -82.91% reduction, impacting the portfolio by -4.33%. The stock's average trading price was $427.47 during the quarter.

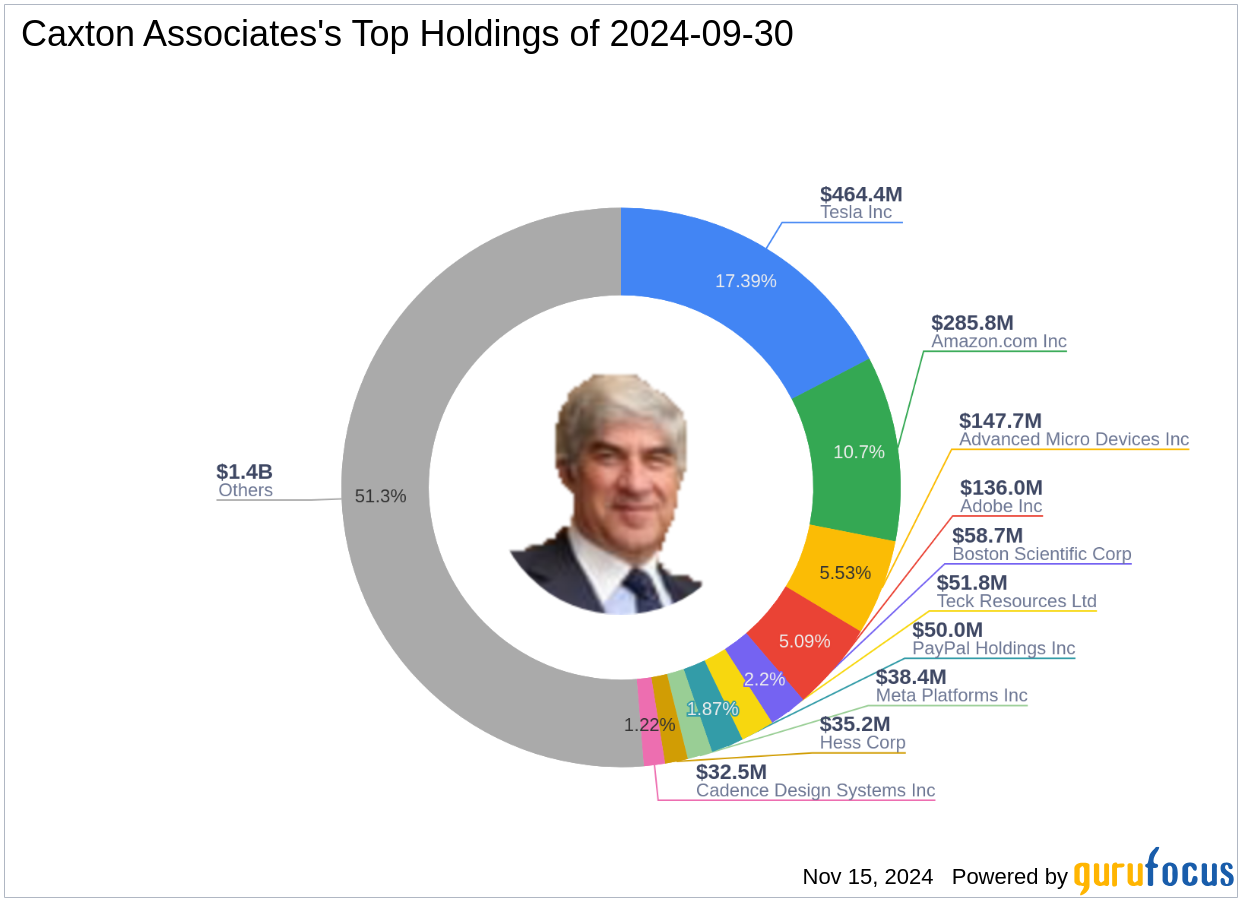

Portfolio Overview and Sector Allocation

As of the third quarter of 2024, Caxton Associates (Trades, Portfolio)' portfolio included 512 stocks. The top holdings were:

- 17.39% in Tesla Inc (TSLA, Financial)

- 10.7% in Amazon.com Inc (AMZN, Financial)

- 5.53% in Advanced Micro Devices Inc (AMD, Financial)

- 5.09% in Adobe Inc (ADBE, Financial)

- 2.2% in Boston Scientific Corp (BSX, Financial)

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.