Overview of Altium Capital's Recent Transaction

On September 30, 2024, Altium Capital Management LP (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 95,483 shares of Evoke Pharma Inc (NASDAQ:EVOK). This transaction increased the firm's total holdings in Evoke Pharma to 153,186 shares, marking a notable expansion of its stake by 165.47%. The shares were purchased at a price of $4.76 each, reflecting a strategic move by the firm to bolster its position in the healthcare sector.

Insight into Altium Capital Management LP (Trades, Portfolio)

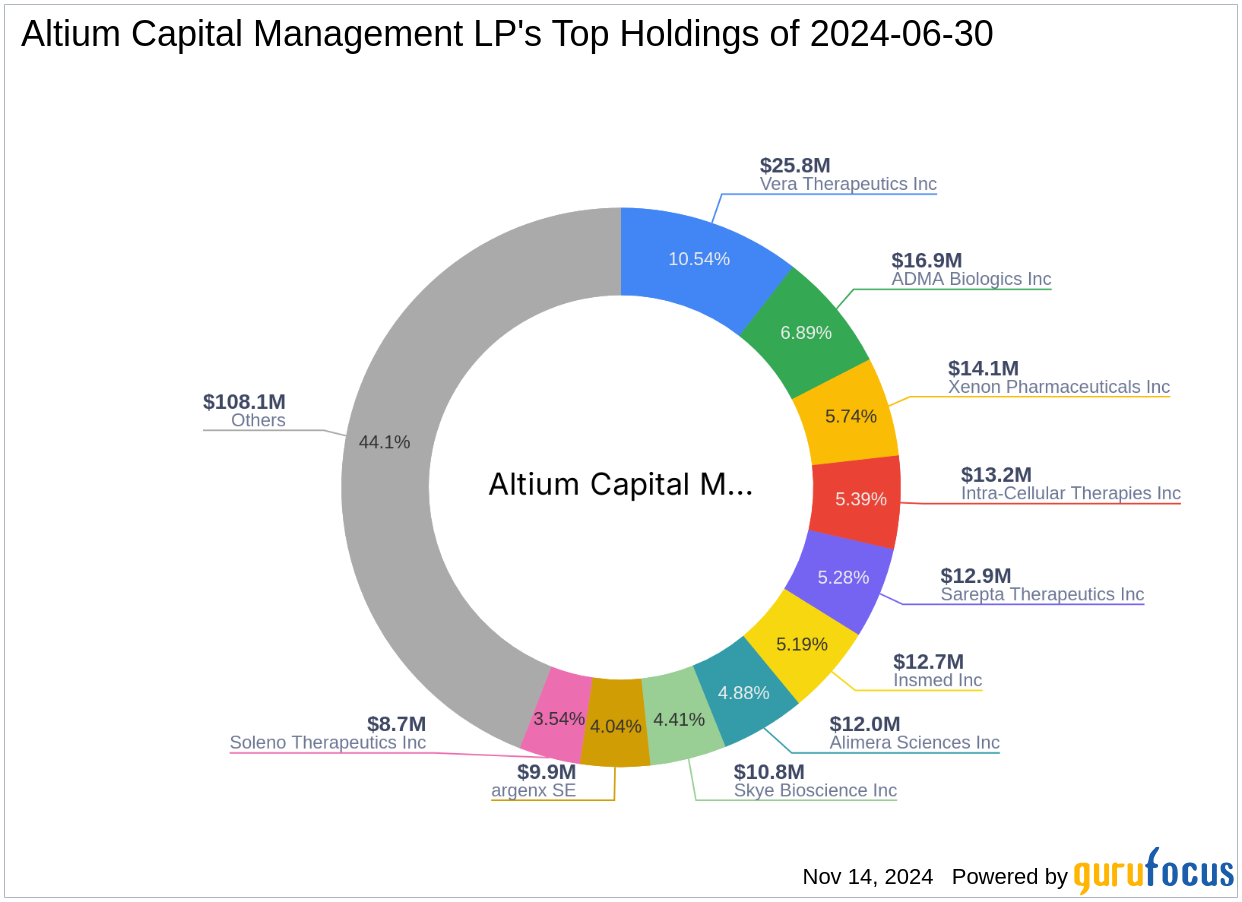

Altium Capital Management LP (Trades, Portfolio), based in New York, is a prominent investment firm with a keen focus on the healthcare and consumer cyclical sectors. The firm manages an equity portfolio valued at approximately $245 million and holds investments in 68 stocks. Its top holdings include ADMA Biologics Inc (ADMA, Financial), Intra-Cellular Therapies Inc (ITCI, Financial), and Sarepta Therapeutics Inc (SRPT, Financial), among others. Altium Capital is known for its strategic investment choices aimed at long-term value creation.

Evoke Pharma Inc at a Glance

Evoke Pharma Inc, a specialty pharmaceutical company based in the USA, focuses on developing treatments for gastrointestinal disorders. Its flagship product, Gimoti, is a nasal spray designed for the relief of symptoms associated with diabetic gastroparesis in women. Despite its innovative approach, Evoke Pharma has a market capitalization of just $6.411 million and faces significant challenges reflected in its financial metrics.

Financial and Market Performance of Evoke Pharma

Evoke Pharma's financial health appears strained with a Return on Equity (ROE) of -1005.55% and a Return on Assets (ROA) of -67.31%. The company's stock has experienced a substantial decline, with a year-to-date performance of -65.09% and a staggering -99.73% drop since its IPO. The GF Score of 44/100 indicates poor future performance potential, further compounded by a GF Value suggesting the stock is a possible value trap.

Impact of Altium's Trade on Its Portfolio

The recent acquisition of Evoke Pharma shares has a modest impact on Altium Capital's portfolio, increasing its position by 0.19%. This move brings the firm's total stake in Evoke Pharma to 0.3% of its portfolio, representing a 4.99% ownership in the company. This strategic addition underscores Altium's commitment to investing in the healthcare sector, despite the current challenges faced by Evoke Pharma.

Current Market and Sector Analysis

The pharmaceutical sector is currently facing a myriad of challenges, including regulatory hurdles and market volatility. Evoke Pharma's performance, particularly in terms of stock price and financial stability, reflects these broader sector issues. However, Altium Capital's investment could be seen as a move to capitalize on potential long-term gains from Evoke's specialized pharmaceutical products.

Future Outlook and Strategic Positioning

Looking ahead, Evoke Pharma's focus on niche medical treatments could offer unique opportunities, especially if Gimoti gains further market acceptance. For Altium Capital, the investment in Evoke Pharma represents a calculated risk, balancing potential high rewards against the current financial instability of the company. Investors and market watchers will be keenly observing how this gamble plays out in the evolving pharmaceutical landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.