Overview of Recent Transaction

On September 30, 2024, the investment firm Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio) made a significant adjustment to its holdings in Kaiser Aluminum Corp (KALU, Financial), a prominent player in the metals and mining industry. The firm reduced its stake by 4,405 shares, resulting in a new total of 822,580 shares. Despite this reduction, the firm maintains a substantial interest in KALU, with the stock comprising 0.2% of its portfolio and representing 5.15% of the total shares outstanding.

Investment Firm Profile

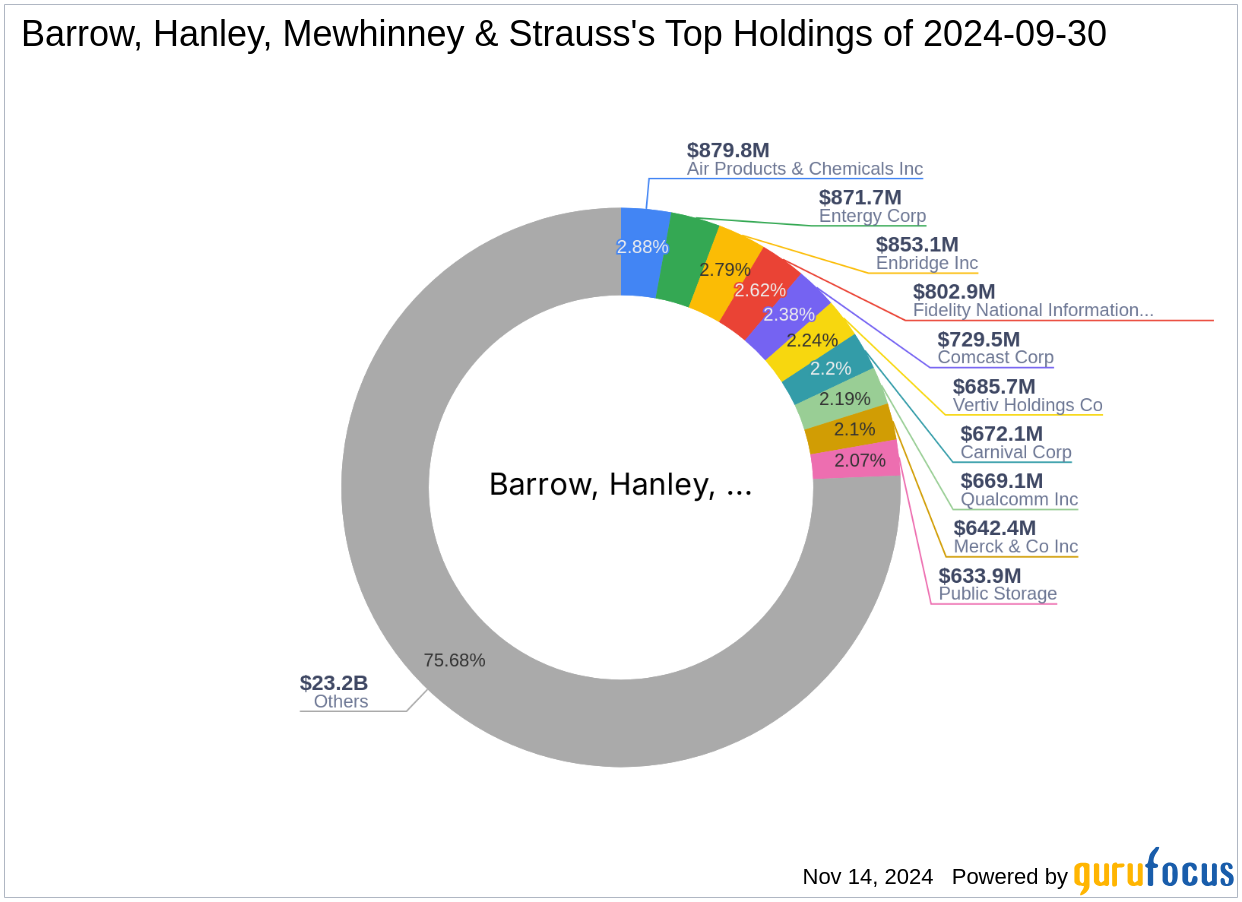

Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio), a Dallas-based investment firm, is renowned for its conservative investment philosophy. The firm focuses on acquiring stocks with below-market price-to-earnings ratios, below-market price-to-book ratios, and above-market dividend yields. Over the past decade, their Selected Value Funds have outperformed the market, averaging a 9.33% annual return. The firm's top holdings include significant stakes in companies like Comcast Corp (CMCSA, Financial) and Air Products & Chemicals Inc (APD, Financial).

Kaiser Aluminum Corp Analysis

Kaiser Aluminum Corp, headquartered in the USA, specializes in the production and sale of semi-fabricated specialty aluminum products. These products are primarily supplied to industrial sectors, with the majority of revenue generated within the United States. As of the latest data, KALU is considered modestly overvalued with a GF Value of $70.56, while the current stock price stands at $81.8, reflecting a price to GF Value ratio of 1.16.

Impact on Portfolio

The recent transaction by Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio) has slightly decreased their exposure to KALU, yet the firm remains one of the largest shareholders. This adjustment reflects a strategic realignment within their portfolio, possibly in response to the stock's current valuation and market performance.

Market Context and Comparative Insights

The timing of the trade coincides with a period of robust performance for KALU, which has seen a 12.8% increase in stock price since the transaction date. Other notable investors in KALU include First Eagle Investment (Trades, Portfolio) and Ken Fisher (Trades, Portfolio), indicating a strong interest from value-oriented investment firms. Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio)'s position remains significant compared to these investors, highlighting their confidence in the stock's long-term potential despite the recent sell-off.

Future Outlook and Conclusion

Looking ahead, Kaiser Aluminum's strategic positioning within the industrial sector, combined with its ongoing financial performance, suggests potential for continued growth. The firm's decision to reduce its stake might be seen as a tactical move to capitalize on recent price increases or to rebalance its portfolio in light of broader market conditions. As market dynamics evolve, Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio)'s adept adjustments in their investment strategy will be crucial in maintaining their track record of success.

In conclusion, this transaction underscores the firm's active management approach and its commitment to adhering to its investment philosophy, even in fluctuating market environments.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.