Overview of the Recent Transaction

On November 8, 2024, FMR LLC (Trades, Portfolio), a prominent investment firm, expanded its portfolio by acquiring an additional 7,177,686 shares of ZoomInfo Technologies Inc (ZI, Financial). This transaction increased FMR LLC (Trades, Portfolio)'s total holdings in the company to 33,053,421 shares, marking a significant endorsement of ZoomInfo's market position and potential. The shares were purchased at a price of $11.99, reflecting a strategic move by the firm amidst the current market dynamics.

Profile of FMR LLC (Trades, Portfolio)

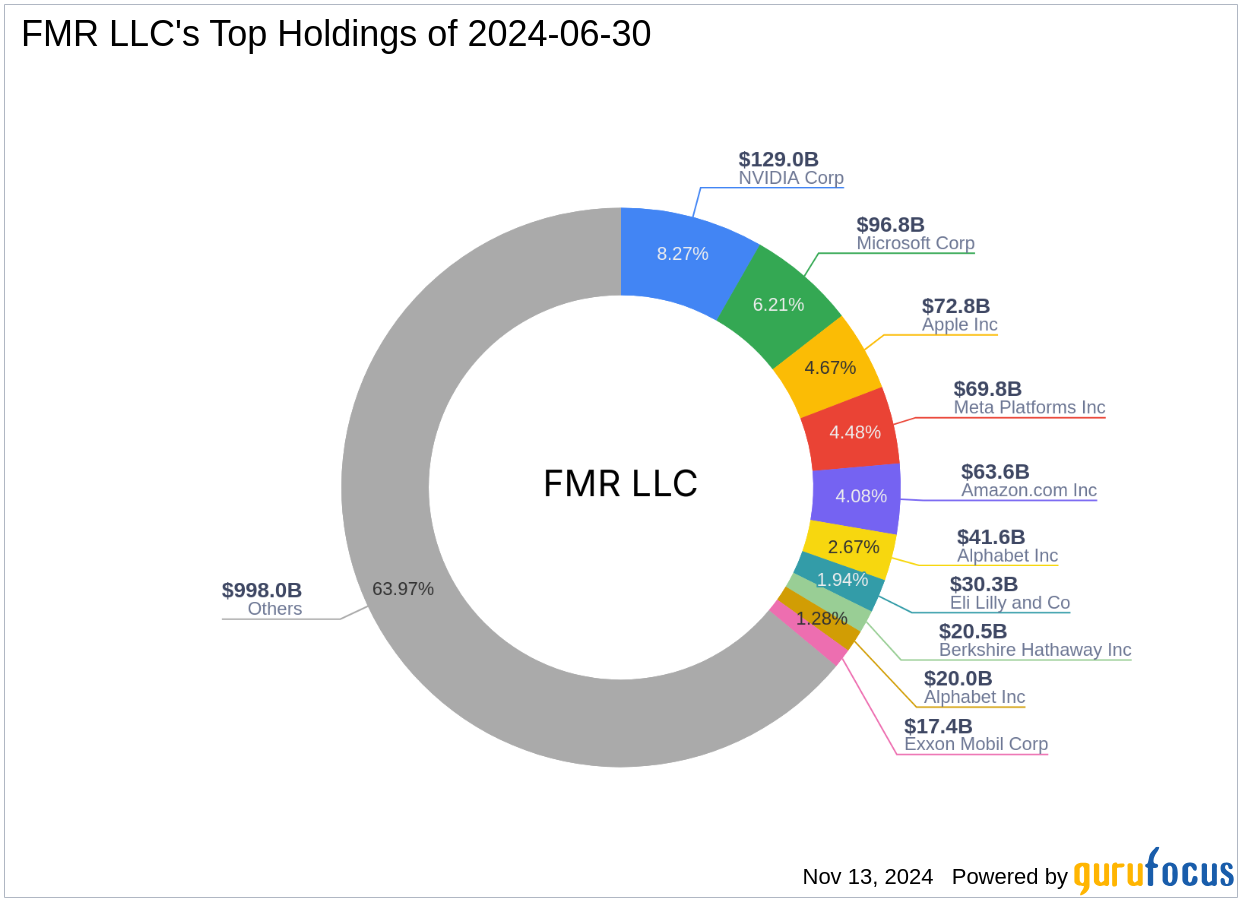

Founded in 1946 by Edward C. Johnson II, FMR LLC (Trades, Portfolio), commonly known as Fidelity, has grown from a bold mutual fund company into a diversified financial services giant. Under the leadership of CEO Abigail Johnson, Fidelity continues to innovate, emphasizing strong, individualistic investment strategies. The firm manages a vast portfolio, including top holdings in major corporations such as Apple Inc (AAPL, Financial) and Microsoft Corp (MSFT, Financial). Fidelity's approach combines aggressive growth tactics with a keen eye for emerging market trends, maintaining its position as a leader in the investment world.

Insight into ZoomInfo Technologies Inc

ZoomInfo Technologies Inc operates a robust go-to-market intelligence platform essential for sales and marketing teams across the United States. Since its IPO on June 4, 2020, ZoomInfo has focused on delivering high-quality, actionable data to drive business growth. Despite challenging market conditions, the company has maintained a strategy of steady revenue streams primarily through subscription services, contributing to a market capitalization of $4.78 billion.

Analysis of the Trade Impact

The recent acquisition by FMR LLC (Trades, Portfolio) has not only increased its influence over ZoomInfo but also reflects confidence in the company's future performance. Holding 9.05% of ZoomInfo's shares, FMR LLC (Trades, Portfolio) has solidified its position as a key stakeholder with significant sway over corporate decisions. This move is aligned with Fidelity's history of investing in high-potential markets, potentially setting the stage for substantial returns on investment.

Market Context and Stock Valuation

ZoomInfo's current valuation poses a complex scenario. The stock is trading at a price significantly below its GF Value, labeled as a "Possible Value Trap" which suggests investors should think twice. Despite a high PE Ratio of 327.38, the stock's price has seen a 9.09% increase since the transaction date, indicating a volatile yet potentially rewarding market perception.

Sector and Market Analysis

FMR LLC (Trades, Portfolio)'s top sectors include technology and healthcare, areas that have shown resilience and innovation-driven growth. ZoomInfo, falling under the technology sector, aligns well with FMR LLC (Trades, Portfolio)'s strategic focus, suggesting a calculated move to leverage sectoral trends and future growth opportunities.

Other Significant Investors

Gotham Asset Management, LLC, and Jefferies Group (Trades, Portfolio) are also notable investors in ZoomInfo, with varying strategies and shareholding percentages. This diverse interest from multiple financial powerhouses underscores ZoomInfo's appeal in the investment community.

Conclusion

The strategic acquisition of ZoomInfo shares by FMR LLC (Trades, Portfolio) underscores its commitment to investing in high-growth potential companies. This move is not only significant in terms of portfolio diversification but also reflects Fidelity's adaptive strategies in navigating the complex market landscapes. As the market continues to evolve, the impact of this transaction will be closely monitored by investors and analysts alike, offering insights into both ZoomInfo's operational success and FMR LLC (Trades, Portfolio)'s investment acumen.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.