Overview of the Recent Transaction

On November 8, 2024, FMR LLC (Trades, Portfolio), a prominent investment firm, executed a notable transaction by acquiring 52,419 additional shares of Range Resources Corp (RRC, Financial), a key player in the oil and gas industry. This acquisition increased FMR LLC (Trades, Portfolio)'s total holdings in the company to 27,478,205 shares, reflecting a significant commitment to RRC. The shares were purchased at a price of $33.03, underscoring a strategic investment move by the firm.

Profile of FMR LLC (Trades, Portfolio)

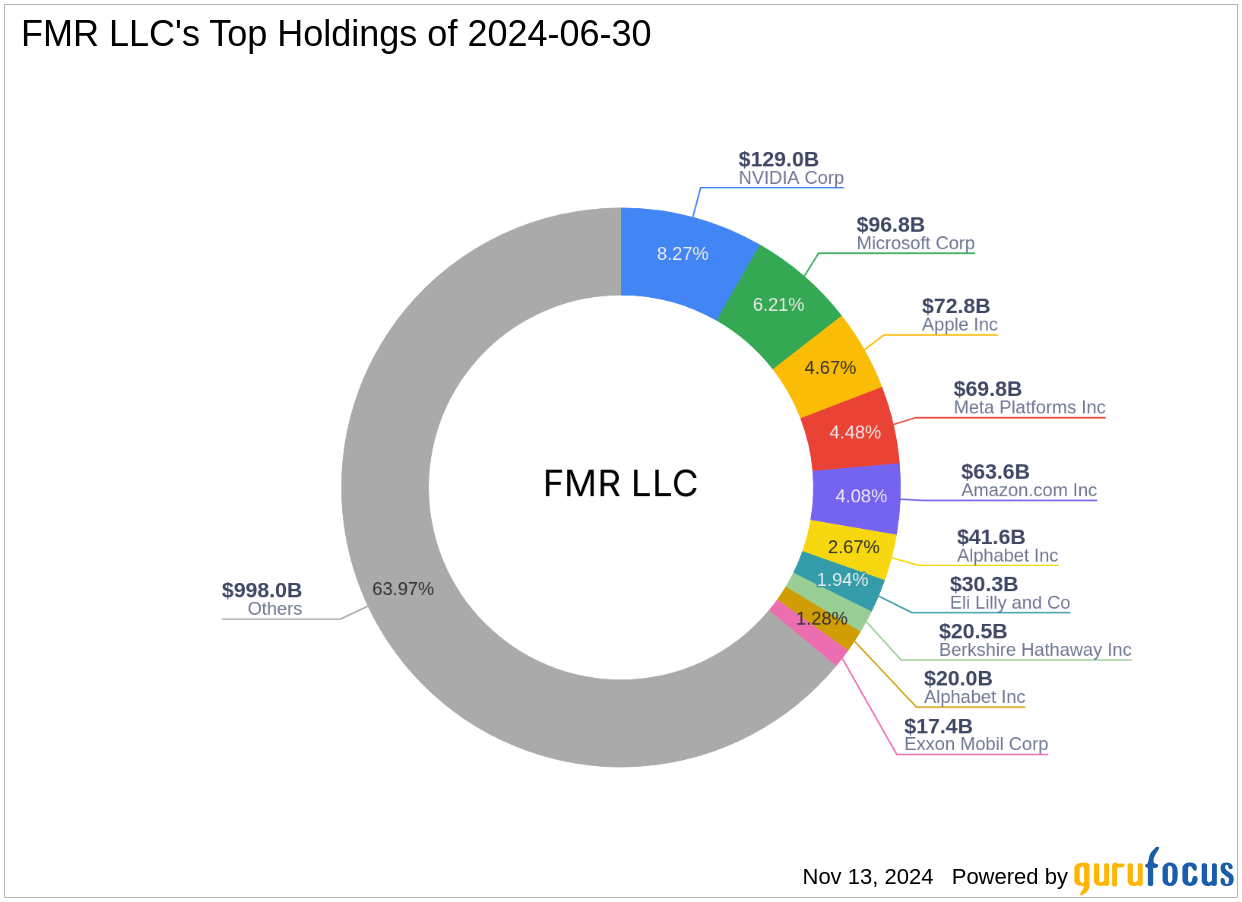

Founded in 1946 by Edward C. Johnson II, FMR LLC (Trades, Portfolio), commonly known as Fidelity, has grown into a powerhouse in the investment world. The firm is renowned for its risk-taking approach and focus on growth potential. Fidelity's investment philosophy emphasizes individual decision-making and innovation, which has propelled its assets under management to surpass $1 trillion. The firm's top holdings include major names like Apple Inc (AAPL, Financial) and Amazon.com Inc (AMZN, Financial), predominantly in the technology and healthcare sectors.

Insight into Range Resources Corp

Range Resources Corp, headquartered in Fort Worth, Texas, is an independent exploration and production company dedicated to its operations in the Marcellus Shale in Pennsylvania. As of the end of 2023, the company boasted proven reserves of 18.1 trillion cubic feet equivalent and a daily net production rate of 2.14 billion cubic feet equivalent. The company's market capitalization stands at $8.23 billion, with a current stock price of $34.09, reflecting a PE ratio of 16.96.

Analysis of the Trade's Impact

The recent acquisition by FMR LLC (Trades, Portfolio) has increased its stake in RRC to 11.35%, making it a significant shareholder. This move is indicative of FMR LLC (Trades, Portfolio)'s confidence in RRC's value and potential for growth. The firm's strategic investment in RRC now represents 0.06% of its total portfolio, highlighting the importance of this asset in its investment strategy.

Market and Financial Analysis of RRC

Despite being labeled as significantly overvalued with a GF Value of $19.02 and a price to GF Value ratio of 1.79, RRC shows a promising GF Score of 65/100, suggesting a moderate future performance potential. The company maintains a solid profitability rank of 6/10 and a growth rank of 6/10, with a notable ROE of 12.83% and ROA of 6.70%. However, its financial strength could be a concern with a cash to debt ratio of 0.15 and an interest coverage of 3.02.

Comparative Insight and Sector Trends

Other significant shareholders in RRC include Fisher Asset Management, LLC, and firms like Jefferies Group (Trades, Portfolio) and HOTCHKIS & WILEY. The oil and gas sector is currently experiencing dynamic shifts, with trends likely influencing RRC's operations and, consequently, its attractiveness to investors like FMR LLC (Trades, Portfolio).

Conclusion

FMR LLC (Trades, Portfolio)'s recent acquisition of additional shares in Range Resources Corp aligns with its history of strategic, growth-focused investments. Given the firm's significant stake and the potential within the oil and gas sector, this move could be seen as a calculated step towards capitalizing on industry trends and enhancing portfolio value. The future performance of RRC will be crucial in determining the success of FMR LLC (Trades, Portfolio)'s investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.