Introduction to the Transaction

On November 8, 2024, FIL Ltd (Trades, Portfolio), a prominent asset management firm, expanded its investment portfolio by acquiring 27,902,489 shares of Autohome Inc (ATHM, Financial), a leading online automobile platform based in China. This transaction, executed at a price of $27.90 per share, significantly increased FIL Ltd (Trades, Portfolio)'s holdings in Autohome, bringing the total to 35,172,832 shares. This move not only underscores FIL Ltd (Trades, Portfolio)'s strategic investment approach but also highlights its confidence in Autohome's market position and future growth prospects.

Profile of FIL Ltd (Trades, Portfolio)

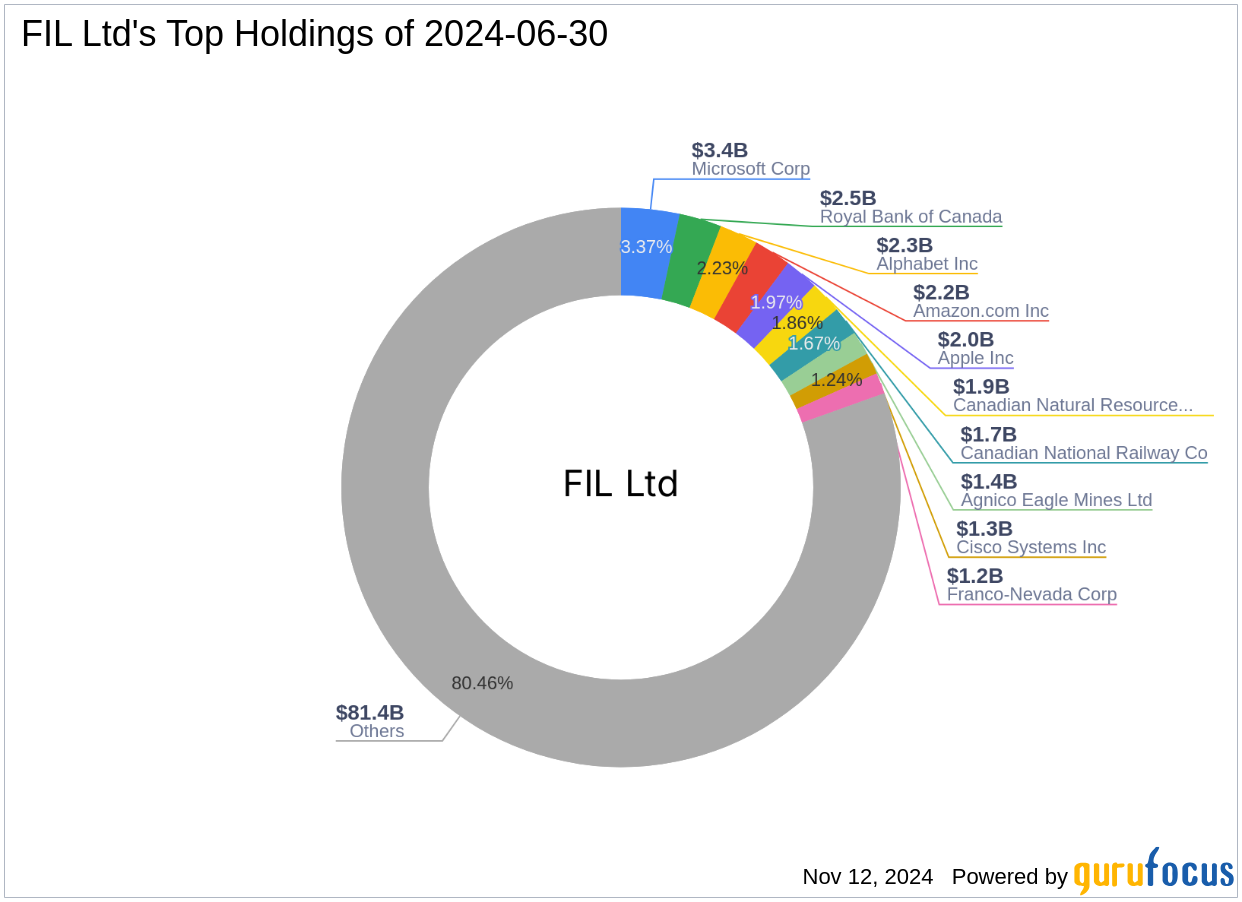

FIL Ltd (Trades, Portfolio), known as Fidelity Worldwide Investments, was established in 1969 and has grown into a global powerhouse in asset management with a presence in 24 countries. The firm is renowned for its research-driven, bottom-up investment approach, focusing on long-term value creation across various asset classes. With a diverse client base that includes major institutions and retail investors, FIL Ltd (Trades, Portfolio) manages an impressive equity portfolio worth $101.12 billion, heavily weighted towards technology and financial services sectors.

Details of the Trade

The recent acquisition by FIL Ltd (Trades, Portfolio) has not only increased its stake in Autohome Inc to 7.14% but also raised its portfolio position to 0.96%. This transaction, with a trade impact of 0.76%, reflects a strategic enhancement of FIL Ltd (Trades, Portfolio)'s holdings, emphasizing its bullish outlook on the automotive sector in China.

Overview of Autohome Inc

Autohome Inc, established in 2008, operates China's premier online platform for automobile consumers and service providers. It offers a comprehensive suite of services ranging from media content to lead generation, primarily through its websites autohome.com.cn and che168.com. As a market leader, Autohome has been pivotal in transforming how automotive marketing and sales are conducted in China, leveraging its extensive user base and innovative technology.

Financial and Market Analysis of Autohome Inc

Currently, Autohome Inc is valued at a market capitalization of $3.25 billion, with a stock price of $26.81, slightly below its recent trading price due to market fluctuations. The company holds a PE ratio of 13.38, indicating profitability, and is rated as 'Fairly Valued' with a GF Value of $29.02. Despite recent market challenges reflected in a year-to-date price decline of 3.07%, Autohome maintains a strong financial foundation with a GF Score of 79/100, suggesting potential for future performance.

Comparative Analysis

Other notable investors in Autohome include Barrow, Hanley, Mewhinney & Strauss, and Prem Watsa (Trades, Portfolio), indicating a strong interest from institutional investors. FIL Ltd (Trades, Portfolio)'s recent purchase positions it among the top shareholders, emphasizing the stock's attractiveness to seasoned investors looking for value in the Chinese tech sector.

Market Impact and Future Outlook

The increased stake by FIL Ltd (Trades, Portfolio) could signal a positive market sentiment towards Autohome Inc, potentially influencing its stock performance positively. Looking forward, Autohome's focus on innovation and market expansion could drive further growth, benefiting long-term investors like FIL Ltd (Trades, Portfolio).

Conclusion

The acquisition of a substantial stake in Autohome Inc by FIL Ltd (Trades, Portfolio) marks a significant endorsement of the company's market position and growth strategy. This strategic investment not only enhances FIL Ltd (Trades, Portfolio)'s portfolio but also positions it to capitalize on the expanding digital automobile market in China. As Autohome continues to innovate and lead in its sector, FIL Ltd (Trades, Portfolio)'s stakeholders can anticipate potentially lucrative returns influenced by the company's sustained growth and market leadership.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.