Overview of Goldman Sachs' Recent Transaction

On September 30, 2024, Goldman Sachs Group Inc executed a significant transaction involving the shares of Perfect Corp (PERF, Financial), a company based in Taiwan. The firm reduced its holdings by 2,407,172 shares, resulting in a new total of 3,516,554 shares. This move is part of a broader strategy, reflecting a -40.64% change in their position, with the shares priced at $1.9201 during the transaction.

Goldman Sachs Group Inc: A Pillar in Financial Markets

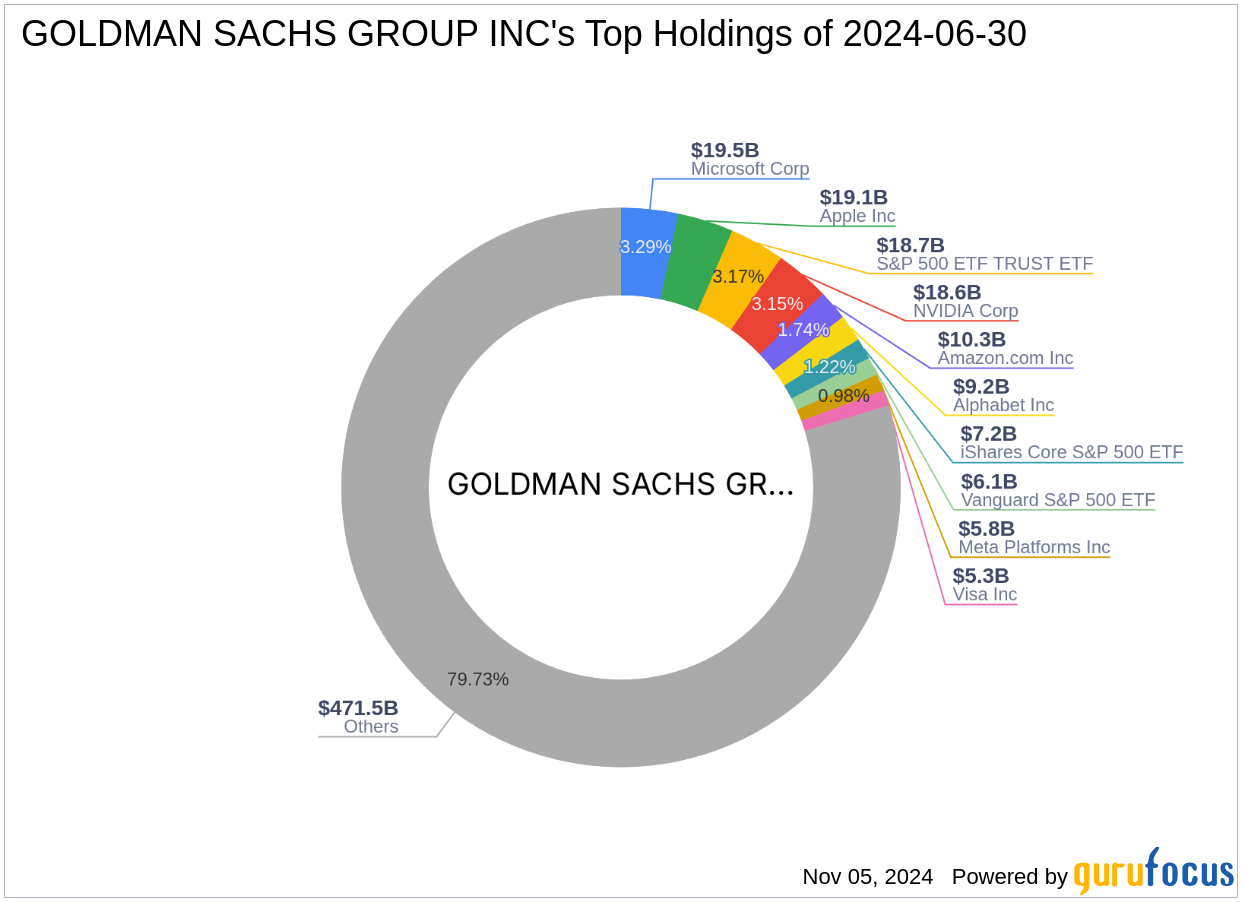

Founded in 1869, Goldman Sachs has grown into a powerhouse in global finance, known for its robust role in investment banking, asset management, and other financial services. With a history marked by involvement in significant IPOs and innovative financial practices, the firm has been a pivotal player on the New York Stock Exchange since 1896. Today, Goldman Sachs continues to influence the financial markets with a diverse portfolio and a strategic focus on technology and financial services sectors.

Introducing Perfect Corp

Perfect Corp specializes in beauty and fashion technology, offering integrated solutions that range from artificial reality and artificial intelligence cloud solutions to subscription and licensing services. Since its IPO on October 31, 2022, Perfect Corp has established a significant presence in markets including the United States, France, and Japan, focusing on innovative, interactive consumer experiences.

Impact of the Trade on Goldman Sachs' Portfolio

The recent reduction in Perfect Corp shares by Goldman Sachs marks a notable adjustment in the firm's investment strategy, although it did not significantly impact the overall portfolio due to a 0% trade impact. This adjustment reflects a strategic realignment with the firm's investment objectives and market outlook.

Market and Financial Analysis of Perfect Corp

Currently, Perfect Corp's stock is trading at $1.93, showing a slight increase of 0.52% since the transaction. However, the stock has experienced a significant decline of 87.78% since its IPO and a 37.74% drop year-to-date. Financially, Perfect Corp struggles with a GF Score of 46/100, indicating potential challenges in future performance. The company's financial strength and growth metrics, such as a Cash to Debt ratio of 249.13 and a Revenue Growth of 21.40% over three years, suggest some areas of robustness amidst overall volatility.

Broader Industry and Future Outlook

Goldman Sachs' interest in technology and financial services sectors aligns with its investment in Perfect Corp, which operates within the dynamic software industry. Looking forward, the market trends and the innovative drive in tech-related sectors will likely influence Perfect Corp's strategies and, consequently, its market performance. Investors and market watchers will be keen on how Goldman Sachs adjusts its strategies in response to these trends.

Conclusion

This transaction by Goldman Sachs highlights its strategic portfolio management and deep involvement in the technology and financial sectors. As the market conditions evolve, the firm's future moves will be closely watched for insights into broader market trends and investment strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.