Overview of the Recent Transaction

On September 30, 2024, State Street Corp executed a significant transaction involving the sale of 233,086 shares in Xencor Inc (XNCR, Financial), a notable player in the biotechnology sector. This move reduced their holding by 6.95%, resulting in a total of 3,119,290 shares remaining in their portfolio. The shares were traded at a price of $20.11 each. Despite the sizeable reduction, this transaction had a minimal direct impact on State Street Corp’s overall portfolio, maintaining a position ratio of 4.50% in Xencor Inc.

Profile of State Street Corp

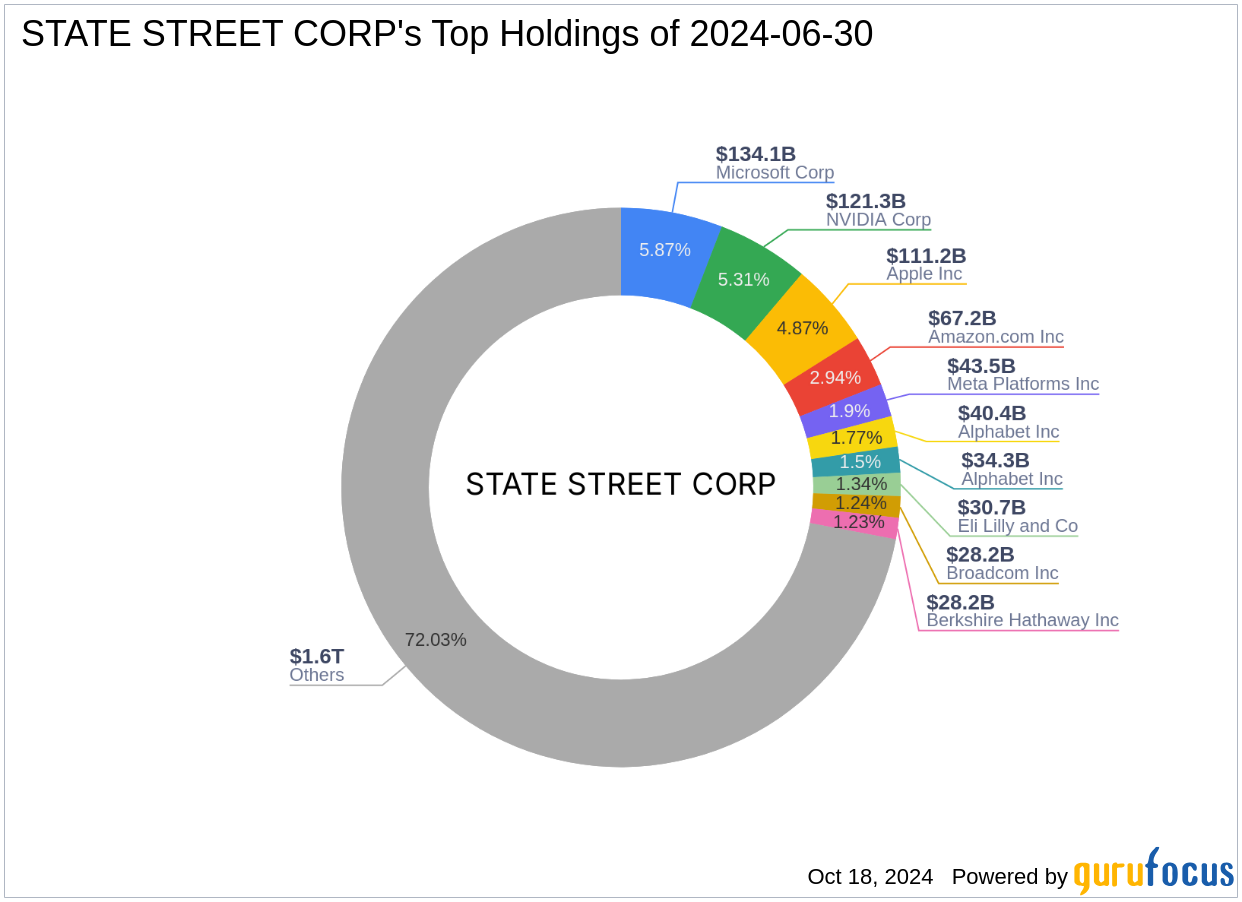

State Street Corp, headquartered at One Lincoln Street, Boston, MA, is a prominent financial services firm with a robust investment philosophy focused on delivering comprehensive financial solutions. The firm manages a diverse portfolio, including top holdings in major technology and financial services companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial). With an equity portfolio valued at approximately $2.29 trillion, State Street Corp is a significant player in the investment community.

Insight into Xencor Inc

Xencor Inc, based in the USA, operates within the biotechnology industry, focusing on the development of monoclonal antibodies and other protein therapeutics for severe diseases. Since its IPO on December 3, 2013, the company has shown a substantial price increase of 265.04%. However, it currently faces challenges with profitability, as indicated by a PE Ratio of 0.00, suggesting it is not generating net income. The stock is considered significantly overvalued with a GF Value of $13.09, while the current stock price stands at $21.72.

Impact of the Trade on State Street Corp’s Portfolio

The recent reduction in Xencor Inc shares by State Street Corp reflects a strategic adjustment in their investment approach, possibly due to the stock's current overvaluation and the company's financial health. This adjustment is part of the firm's broader strategy to optimize returns and manage risks effectively within its extensive portfolio.

Market Reaction and Comparative Stock Performance

Following the transaction, Xencor Inc’s stock price experienced an 8.01% increase, indicating a positive market reaction. However, the stock has seen a year-to-date decline of 3.51%, highlighting the volatility and the challenging environment in the biotechnology sector.

Investment Considerations and Risks

Xencor Inc holds a GF Score of 58/100, suggesting poor future performance potential. The company's financial metrics such as Profitability Rank and Growth Rank are low, indicating underlying challenges. Additionally, the Altman Z score of 2.55 points towards potential financial distress.

Sector and Industry Perspective

The biotechnology industry is known for its high volatility and significant investment risks, attributed to extensive research and development costs and regulatory hurdles. State Street Corp’s investment in Xencor Inc aligns with its exposure to high-growth potential sectors, despite the inherent risks.

Conclusion

The recent transaction by State Street Corp, involving the reduction of their stake in Xencor Inc, highlights a strategic shift that aligns with the firm's risk management and investment optimization strategies. For value investors, this move underscores the importance of monitoring financial health and market valuations in the biotechnology sector, where State Street Corp continues to adjust its holdings in response to evolving market conditions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.