Overview of Recent Transaction by State Street Corp

On September 30, 2024, State Street Corp executed a significant transaction involving the shares of Nabors Industries Ltd (NBR, Financial), a prominent player in the oil and gas industry. The firm reduced its holdings by 2,315 shares, which adjusted its total share count to 415,573. Despite this reduction, the transaction had a minimal direct impact on the firm's portfolio, maintaining a 4.40% holding ratio in Nabors Industries Ltd. The shares were traded at a price of $64.47.

Profile of State Street Corp

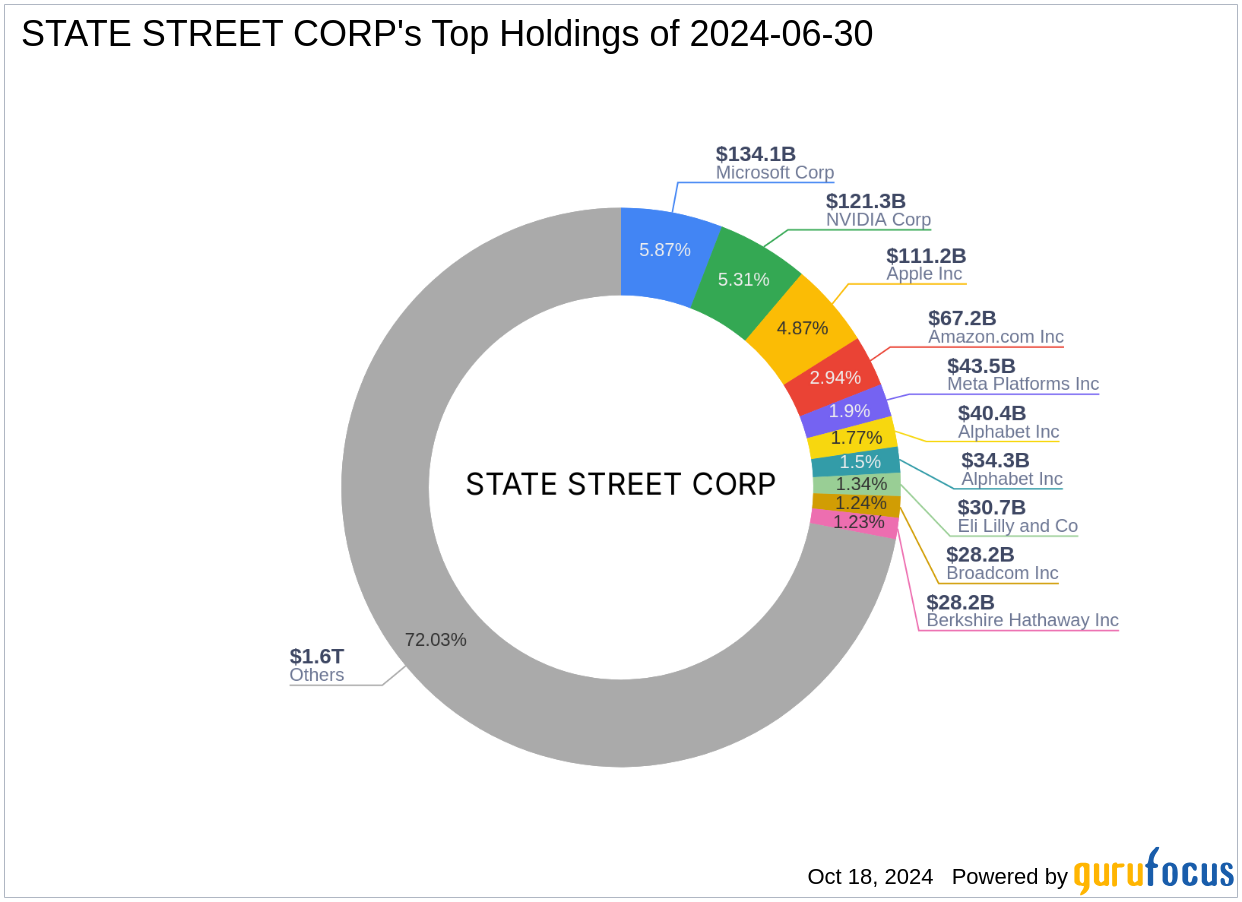

State Street Corp, headquartered at One Lincoln Street, Boston, MA, is a major institutional investor known for its strategic investment decisions. The firm manages a diverse portfolio with a significant emphasis on technology and financial services sectors. Its top holdings include giants like Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial), showcasing a strong inclination towards high-performing tech stocks. The firm's investment philosophy focuses on leveraging market trends and technological advancements to maximize returns.

Introduction to Nabors Industries Ltd

Nabors Industries Ltd, based in Bermuda, operates one of the largest land-based drilling rig fleets globally. Since its IPO on February 28, 1991, the company has expanded its services to include performance tools, directional drilling, and innovative technologies, with operations spanning over 15 countries. The company's business is segmented into U.S. Drilling, Canada Drilling, International Drilling, Drilling Solutions, and Rig Technologies, with a significant revenue contribution from its international drilling operations.

Financial and Market Analysis of Nabors Industries Ltd

Currently, Nabors Industries Ltd holds a market capitalization of approximately $676.71 million, with a recent stock price of $70.87. The stock is considered a possible value trap according to the GF Value, which suggests a cautious approach due to its current price to GF Value ratio of 0.59. Despite a year-to-date price decrease of 12.35%, the stock has shown a gain of 9.93% since the recent transaction by State Street Corp. The company's financial strength and profitability are areas of concern, with a GF Score of 62/100, indicating poor future performance potential.

Impact of the Trade on State Street Corp’s Portfolio

The recent reduction in Nabors Industries Ltd shares by State Street Corp reflects a strategic portfolio adjustment rather than a significant shift. This move aligns with the firm's broader investment strategy, which heavily favors technology and financial sectors, suggesting a reallocation of resources to potentially higher yield areas.

Sector and Market Considerations

State Street Corp's investment focus remains robust in technology and financial services, sectors that are pivotal to its overall strategy. This strategic focus is evident from its top holdings and the substantial equity managed within these sectors, amounting to $2,285.63 trillion.

Comparative Analysis with Other Gurus

Other notable investors in Nabors Industries Ltd include Gotham Asset Management, LLC, which holds a significant share percentage, making it one of the largest shareholders. Comparatively, State Street Corp's holdings represent a strategic but not dominant investment within its diversified portfolio.

Future Outlook and Industry Position

Given the challenging financial metrics and market performance of Nabors Industries Ltd, State Street Corp's decision to reduce its stake might be a prudent move. The future performance of Nabors will likely hinge on improvements in its operational and financial efficiencies, areas currently reflected as underwhelming in its GF Scores and financial rankings.

As the market dynamics evolve, State Street Corp's adept adjustments in its investment portfolio will be crucial in maintaining its strong market position, especially in its favored sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.