Overview of the Recent Transaction

On September 30, 2024, State Street Corp made a significant addition to its investment portfolio by acquiring 223,110 shares of Delek US Holdings Inc (DK, Financial), a prominent player in the oil and gas industry. This transaction, executed at a price of $18.75 per share, increased State Street Corp's total holdings in the company to 3,019,307 shares, marking a notable expansion of its stake.

Introducing State Street Corp

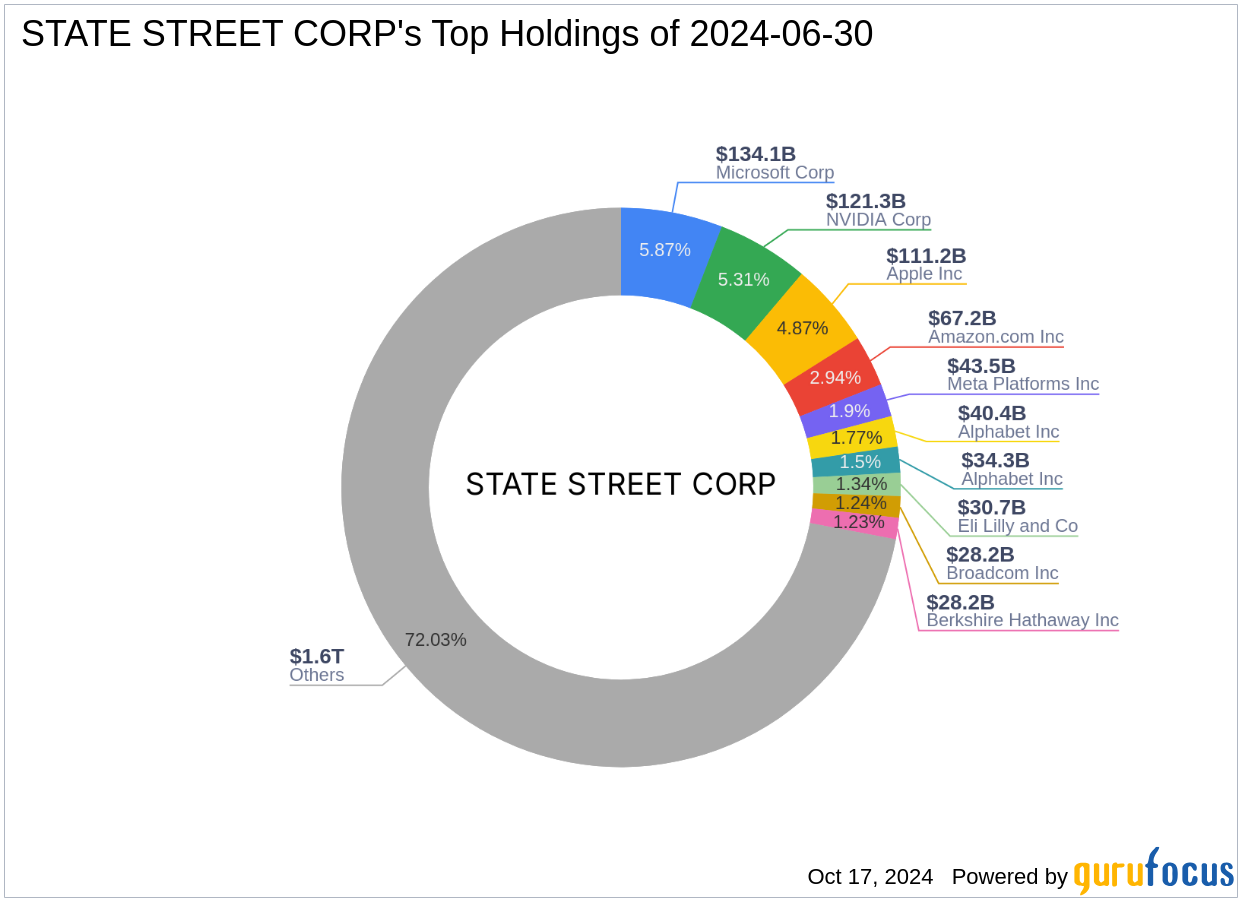

State Street Corp, headquartered at One Lincoln Street, Boston, MA, is a global leader in financial services, providing a broad range of investment management, research, and trading services. With a robust investment philosophy that focuses on diversified global markets, the firm manages an impressive equity portfolio totaling $2,285.63 trillion. State Street Corp's top holdings include giants like Apple Inc (AAPL, Financial) and Amazon.com Inc (AMZN, Financial), with a significant focus on technology and financial services sectors.

Delek US Holdings Inc at a Glance

Delek US Holdings Inc, based in the USA, operates an integrated energy business encompassing petroleum refining, logistics, and convenience store retailing. Since its IPO on May 4, 2006, the company has focused on serving transportation and industrial markets with high-quality petroleum products. Despite a challenging market environment, Delek maintains a market capitalization of $1.11 billion and a current stock price of $17.21, reflecting a modest undervaluation according to the GF Value of $23.74.

Detailed Transaction Insights

The recent acquisition by State Street Corp not only increased its total shares in Delek US Holdings Inc to over 3 million but also adjusted its portfolio's composition, with Delek now representing 4.70% of its total investments. This strategic move underscores the firm's confidence in Delek's value proposition and its alignment with State Street's investment criteria.

Market Impact and Valuation Perspectives

Following the transaction, Delek's stock price experienced a slight decline of 8.21%, indicating market volatility and investor reactions to broader economic factors. However, the stock remains modestly undervalued, with a GF Score of 70/100, suggesting potential for future performance improvement.

Comparative and Sector Analysis

State Street Corp's investment in Delek positions it alongside other major holders like Fisher Asset Management, LLC. Within the oil and gas sector, Delek's financial health, indicated by a Financial Strength rank of 5/10 and a Profitability Rank of 7/10, showcases its resilience and operational efficiency despite industry challenges.

Future Outlook and Performance Metrics

Looking ahead, Delek's strategic initiatives and market positioning suggest a potential rebound. With a solid Piotroski F-Score of 5 and ongoing improvements in operational metrics, the company is poised for gradual growth. State Street Corp's increased investment could be seen as a vote of confidence in Delek's future trajectory, aligning with its broader portfolio strategy focused on value generation and sustainable growth.

In conclusion, State Street Corp's recent acquisition of Delek US Holdings Inc shares represents a strategic enhancement of its investment portfolio, reflecting confidence in the energy sector's long-term prospects. This move is aligned with the firm's broader investment philosophy and market outlook, positioning it well for future capital appreciation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.