Overview of the Recent Transaction

On September 30, 2024, State Street Corp made a significant addition to its investment portfolio by acquiring 2,838,484 shares of Crinetics Pharmaceuticals Inc (CRNX, Financial). This transaction, executed at a price of $51.10 per share, marks a notable expansion in State Street Corp's holdings within the biotechnology sector. The addition of these shares has increased the firm's total stake in Crinetics Pharmaceuticals to a substantial 3.60% of its portfolio, reflecting a strategic move to bolster its presence in the biotech industry.

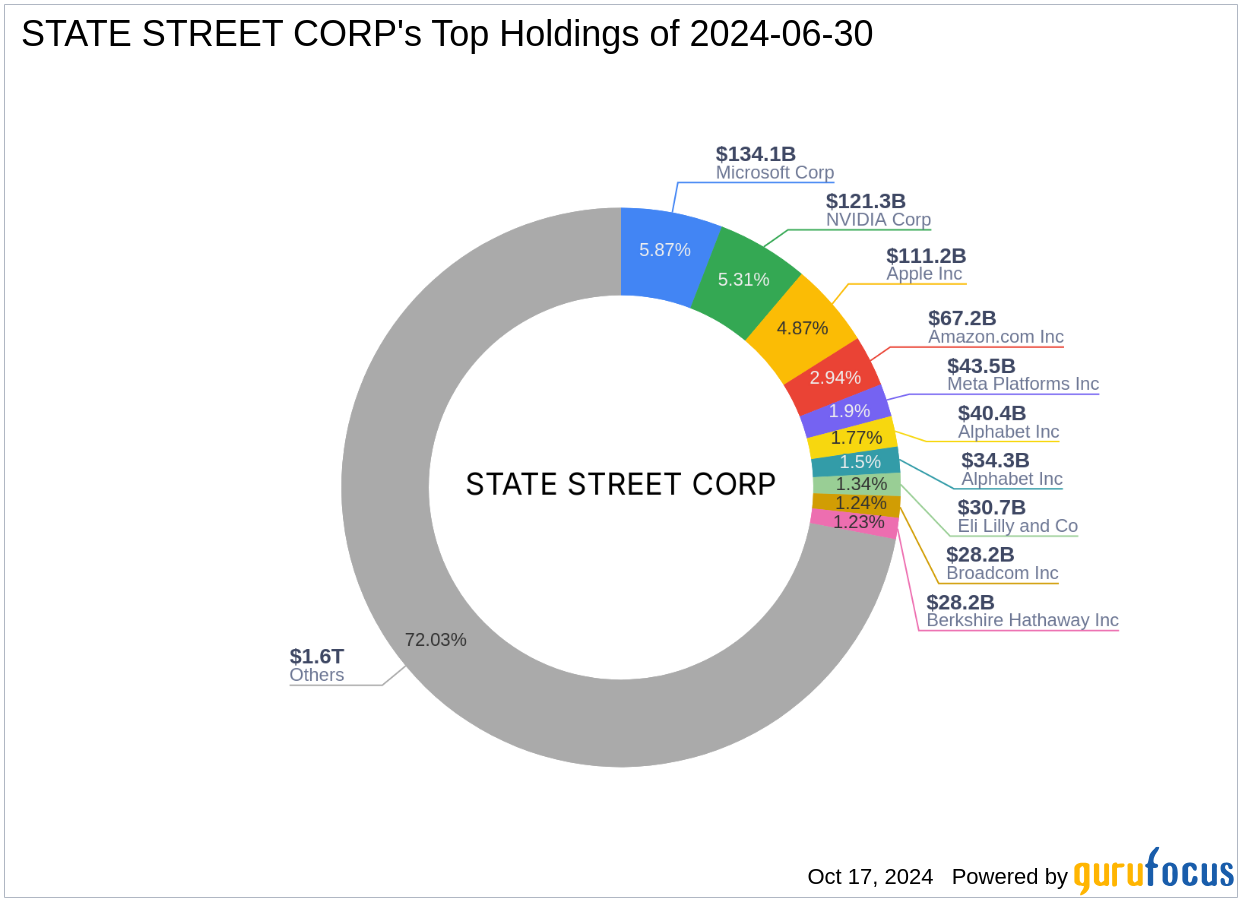

Profile of State Street Corp

Headquartered in Boston, MA, State Street Corp is a prominent financial services provider known for its robust investment strategies and extensive portfolio management expertise. The firm manages a diverse array of assets, with top holdings in major companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and NVIDIA Corp (NVDA, Financial). With a total equity of $2,285.63 trillion, State Street Corp emphasizes investments in technology and financial services, showcasing a keen acumen for high-growth sectors.

Insight into Crinetics Pharmaceuticals Inc

Crinetics Pharmaceuticals Inc, based in the USA, is a clinical-stage pharmaceutical company dedicated to developing novel therapeutics for rare endocrine diseases and tumors. Since its IPO on July 18, 2018, the company has focused on leveraging its proprietary research platform to innovate within the biotechnology field. Despite its current lack of profitability, as indicated by a PE Ratio of 0.00, the company's market capitalization stands at $5.33 billion, reflecting significant investor confidence.

Analysis of the Trade's Impact

The recent acquisition by State Street Corp has not only increased its influence in Crinetics Pharmaceuticals but also adjusted the dynamics of its investment portfolio. The addition of 25,561 shares represents a 0.91% change in the previous holdings, subtly enhancing the firm's stake in the biotechnology sector. This strategic decision aligns with State Street Corp's broader investment philosophy of capitalizing on emerging opportunities in high-growth industries.

Market Performance of Crinetics Pharmaceuticals Post-Transaction

Since the transaction date, Crinetics Pharmaceuticals' stock price has witnessed a commendable increase of 15.95%, climbing to $59.25. This uptick is part of a broader trend, with the stock achieving a 67.42% rise year-to-date and an impressive 207.79% increase since its IPO. These metrics underscore the stock's robust performance and the growing investor interest in the biotechnology sector.

Sector and Market Analysis

State Street Corp's investment in Crinetics Pharmaceuticals aligns with its significant holdings in the technology and financial services sectors, reflecting a strategic diversification into biotechnology. The current market trends in biotech emphasize innovation and rapid growth, factors that likely influenced State Street Corp's decision to increase its stake in Crinetics Pharmaceuticals.

Comparative Insight and Future Outlook

Other notable investors in Crinetics Pharmaceuticals include Ken Fisher (Trades, Portfolio) and Jefferies Group (Trades, Portfolio), with Vanguard Health Care Fund (Trades, Portfolio) being the largest shareholder. Looking ahead, the future potential of Crinetics Pharmaceuticals is cautiously optimistic. Despite a low GF Score of 28/100, indicating challenges in profitability and growth, the ongoing developments and market dynamics could present new opportunities for value realization.

In conclusion, State Street Corp's recent acquisition of shares in Crinetics Pharmaceuticals Inc represents a calculated enhancement to its diverse portfolio, with potential implications for its strategic positioning in the biotechnology sector. As the market continues to evolve, this investment may yield significant outcomes, aligning with the firm's long-term growth objectives.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.