Overview of the Recent Transaction

On September 30, 2024, JPMorgan Chase & Co. made a significant addition to its investment portfolio by acquiring 17,493,612 shares of Western Digital Corp (WDC, Financial). This transaction, executed at a price of $68.29 per share, represents a notable increase of 14,982,035 shares, enhancing the firm's stake in the company. The trade has a modest impact of 0.08% on the firm's portfolio, with Western Digital now constituting 0.1% of JPMorgan's holdings and representing a 5.00% ownership in the traded company.

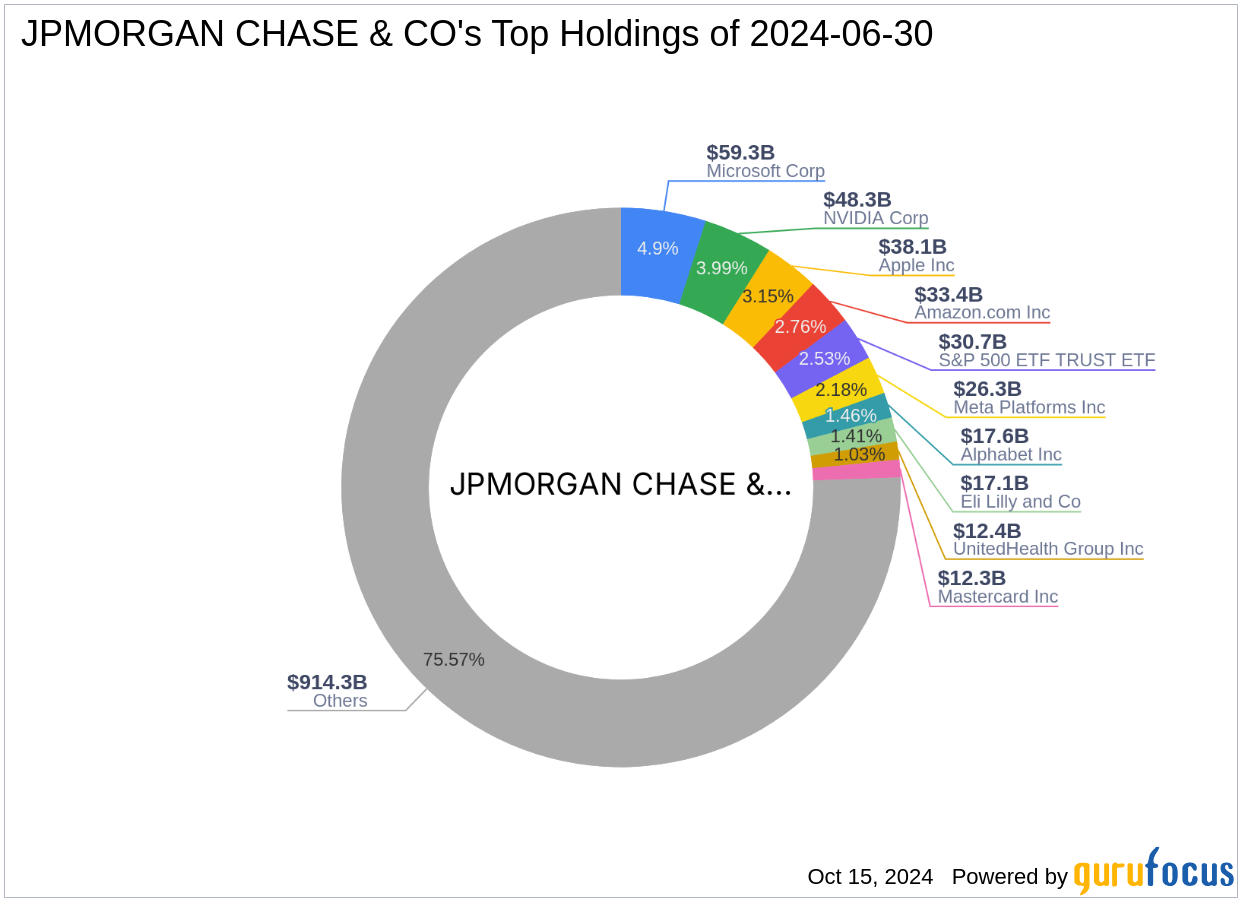

Profile of JPMorgan Chase & Co.

JPMorgan Chase & Co., founded in 1799, has evolved into one of the world's leading financial institutions with a presence in over 60 countries. The firm operates across six major business segments, including investment banking, retail financial services, and asset management. Employing nearly 250,000 individuals globally, JPMorgan manages assets totaling approximately $2.6 trillion. The firm's significant influence in the financial sector is underscored by its top holdings in major corporations such as Apple Inc and Microsoft Corp.

Insight into Western Digital Corp

Western Digital, headquartered in the USA, is a top player in the data storage industry, known for its hard disk drives (HDD) and solid-state drives (SSD). Since its IPO in 1991, the company has grown to achieve a market capitalization of $23.2 billion. Despite its significant market presence, Western Digital is currently facing financial challenges, reflected in its GF Value of $41.83, indicating the stock is significantly overvalued at a current price of $67.12.

Financial and Market Analysis of Western Digital

Western Digital's financial health shows signs of strain with a PE Ratio of 0, indicating losses. The company's GF Score of 64 suggests poor future performance potential. Additionally, the firm's financial strength and profitability are ranked low, with respective scores of 5/10. The stock's year-to-date performance shows a 31.97% increase, yet its long-term growth and profitability metrics remain concerning.

Impact of the Trade on JPMorgan Chase & Co.’s Portfolio

The acquisition of Western Digital shares is a strategic move for JPMorgan, potentially aimed at diversifying its technology sector holdings. This addition slightly increases the technology representation in its portfolio, aligning with its significant positions in other major tech firms. The transaction enhances JPMorgan's influence in the hardware industry, where Western Digital is a key player.

Sector and Market Considerations

The technology and hardware sectors are currently experiencing dynamic shifts, with significant innovations and competitive pressures. JPMorgan's investment in Western Digital positions the firm to capitalize on potential industry growth driven by increasing demand for data storage solutions.

Comparative Analysis with Other Major Holders

Comparing JPMorgan's stake in Western Digital with other major investors, such as Gotham Asset Management, LLC, highlights differing investment strategies in the tech sector. While specific shareholding details of Gotham are not disclosed, JPMorgan's aggressive investment approach is evident from its recent acquisition.

Conclusion

JPMorgan Chase & Co.'s recent acquisition of Western Digital shares marks a strategic enhancement of its portfolio, reflecting a focused investment in the technology sector. Despite Western Digital's current financial challenges, JPMorgan's substantial market presence and strategic investment choices may position it to leverage potential sector growth. Investors and market watchers will closely monitor how this investment influences JPMorgan's future market positioning and financial performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.