Overview of the Recent Transaction

On September 30, 2024, Harel Insurance Investments & Financial Services Ltd. (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 1,706,818 shares of Perion Network Ltd. (PERI, Financial), an Israel-based technology company specializing in digital advertising solutions. This transaction increased Harel's total holdings in Perion to 5,217,731 shares, marking a substantial expansion of its stake by 48.61%. The shares were purchased at a price of $7.88 each, reflecting a strategic move by the firm to bolster its position in the technology sector.

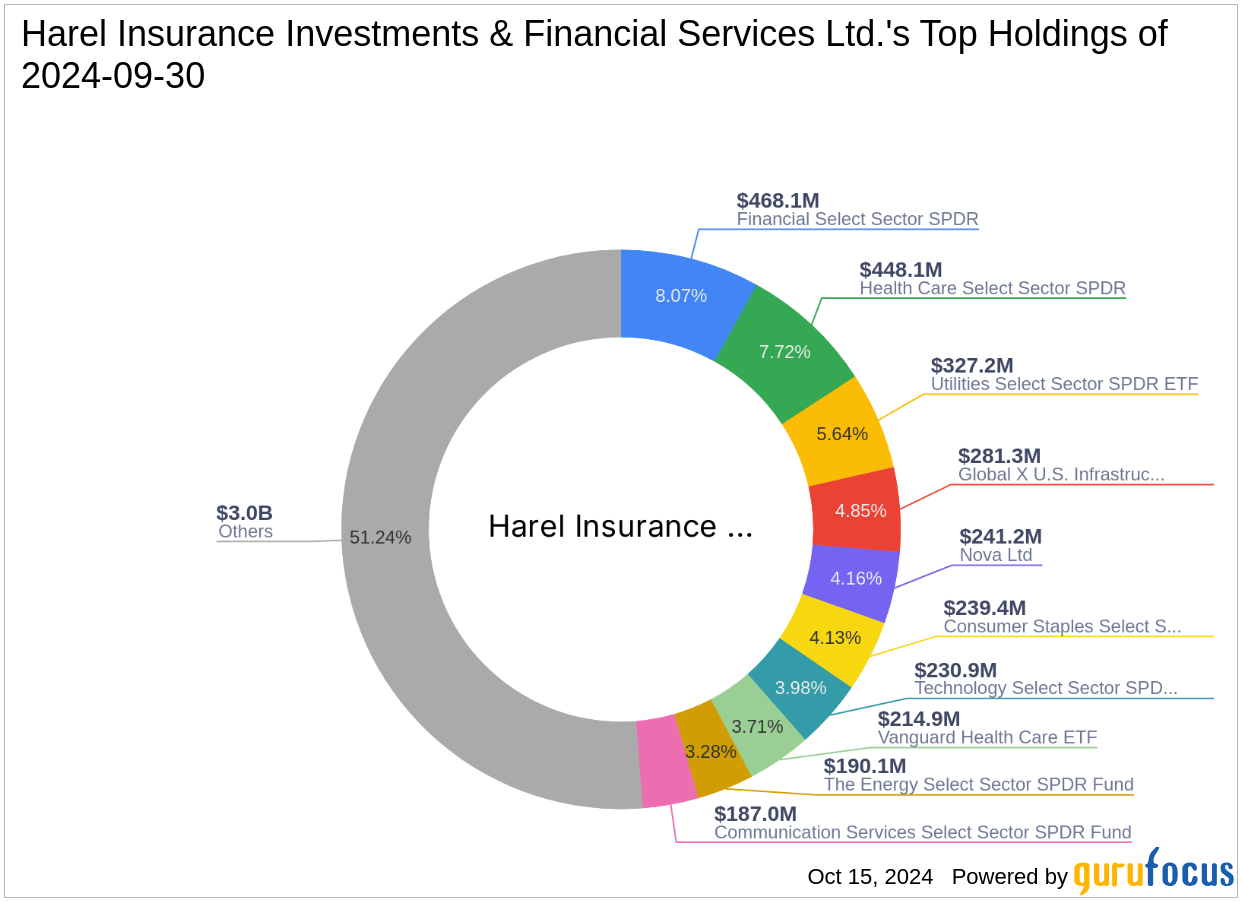

Profile of Harel Insurance Investments & Financial Services Ltd. (Trades, Portfolio)

Headquartered at HAREL HOUSE, 3 ABBA HILLEL ST., RAMAT GAN, L3 52118, Harel Insurance Investments & Financial Services Ltd. (Trades, Portfolio) is a prominent player in the financial services industry. The firm manages an equity portfolio worth approximately $5.8 billion, with a strong emphasis on technology and consumer cyclical sectors. Harel's investment philosophy focuses on long-term growth and stability, leveraging a diversified approach to capture market opportunities.

Insight into Perion Network Ltd.

Perion Network Ltd. operates within the Interactive Media industry, providing high-impact advertising solutions across various digital channels. Since its IPO on January 30, 2006, the company has focused on connecting advertisers with consumers through innovative platforms like search, social media, and video advertising. Despite a challenging market, Perion remains significantly undervalued with a GF Value of $19.00, suggesting a strong potential for growth.

Impact of the Trade on Harel's Portfolio

The recent acquisition has increased Harel's stake in Perion Network Ltd. to 0.77% of its total portfolio, with a substantial 11.00% ownership in the company itself. This strategic addition aligns with Harel's focus on technology and consumer cyclical sectors, potentially enhancing the firm's market position and future returns.

Market Context and Stock Performance

Perion Network Ltd. has experienced a tumultuous year with a year-to-date price decline of 74.2%. However, the stock is currently trading at $7.825, close to the transaction price, and is deemed "Significantly Undervalued" according to the GF-Score of 70/100. This score indicates a potential for poor future performance, which might be a concern for investors.

Comparative Analysis with Industry Peers

In comparison to its peers in the Interactive Media industry, Perion Network Ltd. holds a unique position with its diversified advertising solutions. Financially, the company shows a strong Profitability Rank of 8/10 and a Financial Strength score of 8/10, indicating robust operational and financial metrics despite the industry's competitive nature.

Future Outlook and Strategic Implications

Looking ahead, Perion Network Ltd. is poised to leverage its innovative advertising solutions to capture more market share, especially in the burgeoning sectors of Connected TV and digital audio. For Harel Insurance Investments & Financial Services Ltd. (Trades, Portfolio), this investment not only enhances its exposure to the technology sector but also aligns with its strategy of investing in undervalued assets with strong growth potential.

Closing Summary

This transaction underscores Harel Insurance Investments & Financial Services Ltd. (Trades, Portfolio)'s commitment to expanding its technology portfolio by increasing its stake in Perion Network Ltd. Given the current market dynamics and Perion's strategic positioning, this move could potentially yield significant returns, aligning with Harel's long-term investment philosophy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.