Overview of the Recent Transaction

On September 30, 2024, the investment firm managed by Chuck Royce (Trades, Portfolio) reported a significant addition to its holdings in Aviat Networks Inc (AVNW, Financial), a key player in the networking solutions sector. The firm acquired 54,339 shares at a price of $21.63 each, increasing its total stake to 696,394 shares. This transaction has slightly adjusted the firm's portfolio, now representing 0.14% of its total investments, while its stake in Aviat Networks accounts for 5.54% of the company's shares.

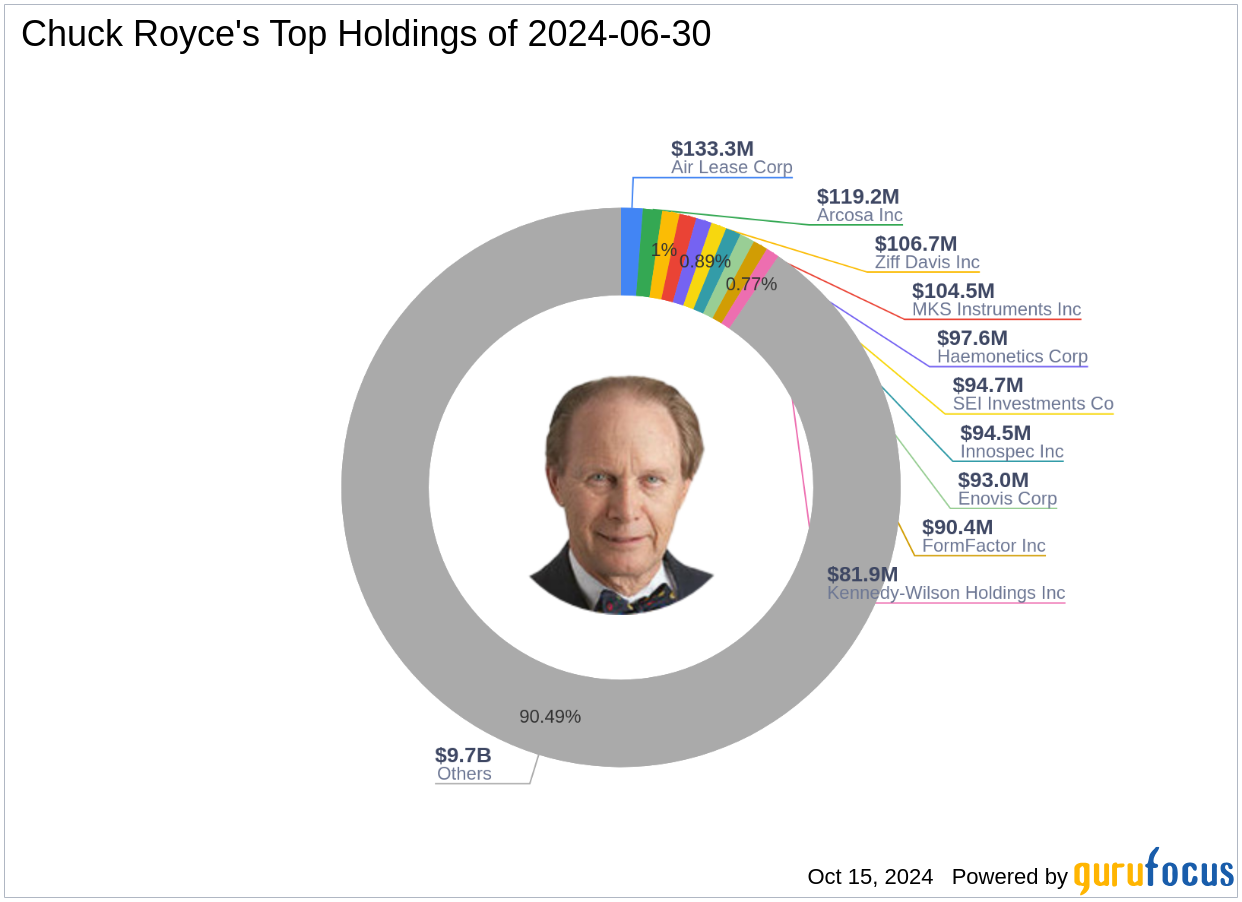

Profile of Chuck Royce (Trades, Portfolio)

Charles M. Royce, a renowned figure in the investment world, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a focus on small-cap investments, the firm targets companies with market caps up to $10 billion, seeking those undervalued relative to their enterprise value. Royce's investment philosophy emphasizes a strong balance sheet, a successful business track record, and future profitability potential. The firm's top holdings include Ziff Davis Inc (ZD, Financial), MKS Instruments Inc (MKSI, Financial), and Air Lease Corp (AL, Financial), predominantly in the industrials and technology sectors, with an equity portfolio valued at $10.7 billion.

About Aviat Networks Inc

Founded in 1991, Aviat Networks Inc offers advanced wireless network solutions and services globally. The company's product line includes point-to-point microwave and millimeter wave radios essential for mobile and fixed operators, government agencies, and various industrial sectors. Despite a challenging market, Aviat holds a market capitalization of $287.186 million, with a stock price of $22.655 as of the latest data, reflecting a 4.74% increase since the transaction date.

Analysis of the Trade Impact

The recent acquisition by Chuck Royce (Trades, Portfolio)'s firm not only increases its influence in Aviat Networks but also aligns with its strategy of investing in undervalued companies with solid fundamentals. The trade's impact on the firm's portfolio is minimal in terms of percentage but significant in demonstrating a continued commitment to the technology and industrial sectors.

Market Context and Stock Performance

Aviat Networks currently trades below its intrinsic value, with a GF Score of 73/100, indicating potential average performance. The stock's price-to-GF Value ratio stands at 0.58, suggesting it might be undervalued. However, its GF Value Rank is only 4/10, which could signal caution. The company's financial strength and profitability are reasonably good, with ranks of 7/10 in both categories.

Comparative Analysis with Other Gurus

Chuck Royce (Trades, Portfolio)'s firm is not the only major investor in Aviat Networks. First Eagle Investment (Trades, Portfolio) Management, LLC holds a significant share, although the exact percentage is undisclosed. Another notable investor is HOTCHKIS & WILEY, indicating that Aviat is a popular choice among seasoned investors.

Strategic Implications of the Trade

The decision to increase the stake in Aviat Networks may be driven by the firm's belief in the company's long-term growth potential and its current undervaluation. This aligns with Chuck Royce (Trades, Portfolio)'s investment philosophy of selecting companies with a promising future and a solid track record.

Conclusion

Chuck Royce (Trades, Portfolio)'s recent investment in Aviat Networks underscores a strategic approach to value investing in the technology sector. With its strong fundamentals and potential for growth, Aviat represents a typical target for Royce's investment criteria. Investors and market watchers will undoubtedly keep a close eye on this developing stake and its implications for both Aviat Networks and the broader market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.