Editor's Picks (Total records: loading...)

🚀 Enjoy a 7-Day Free Trial Thru Jan 11, 2025! ✨

All-In-One Screener

Ben Graham Lost Formula

Canadian Faster Growers

CEO Buys

CEO Buys after Price Drop > 20%

Dividend Kings 2023

Dividend Aristocrats 2023

Dividend Growth Portfolio

Dividend Income Portfolio

Fast Growers

Good Companies

Hedge Fund Guru Top 10 Aggregated

High Quality

High Quality Low Capex w ROE ROC min

High Quality & Low Capex

High Yield Insider Buys

Historical High Dividend Yields

International Gurus' Top Holdings

James Montier Short Screen

Margin Decliners

Mega Caps

Peter Lynch & Warren Buffett

Peter Lynch Growth w Lower Valuation

Peter Lynch S&L Traded Below Book

PFCF Screener

Piotroski Score Screener

Predictable Growth Companies

Profitable predictable margin expanders

Stocks Sold w less Cash

The Stalwarts

Stock Ideas

All-In-One Screener

S&P 500 Map

S&P 500 Bubble

S&P 500 Aggregate

Buffett-Munger Screener

Industry Overview

Undervalued Predictable

Benjamin Graham Net-Net

52-week/3Y/5Y Lows

52-week/3Y/5Y Highs

Magic Formula(Greenblatt)

Dividend Stocks

Peter Lynch Screen

S&P500 Grid

Predictable Companies

Spin Off List

Merger and Acquisition List

Historical Low P/B List

Historical Low P/S List

High Short Interest

Upcoming Special Dividends

Delisted Stocks

Latest Guru Picks

Real Time Picks

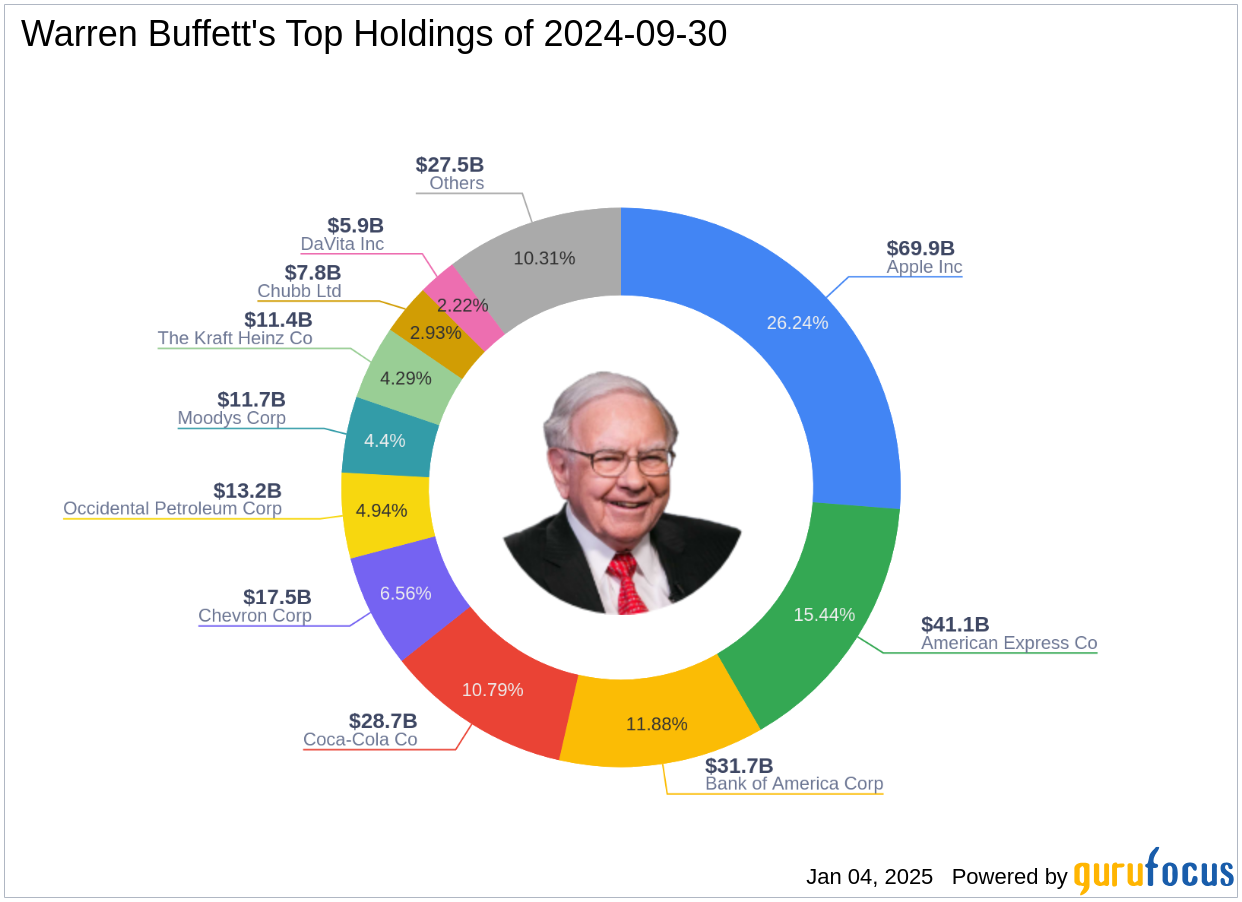

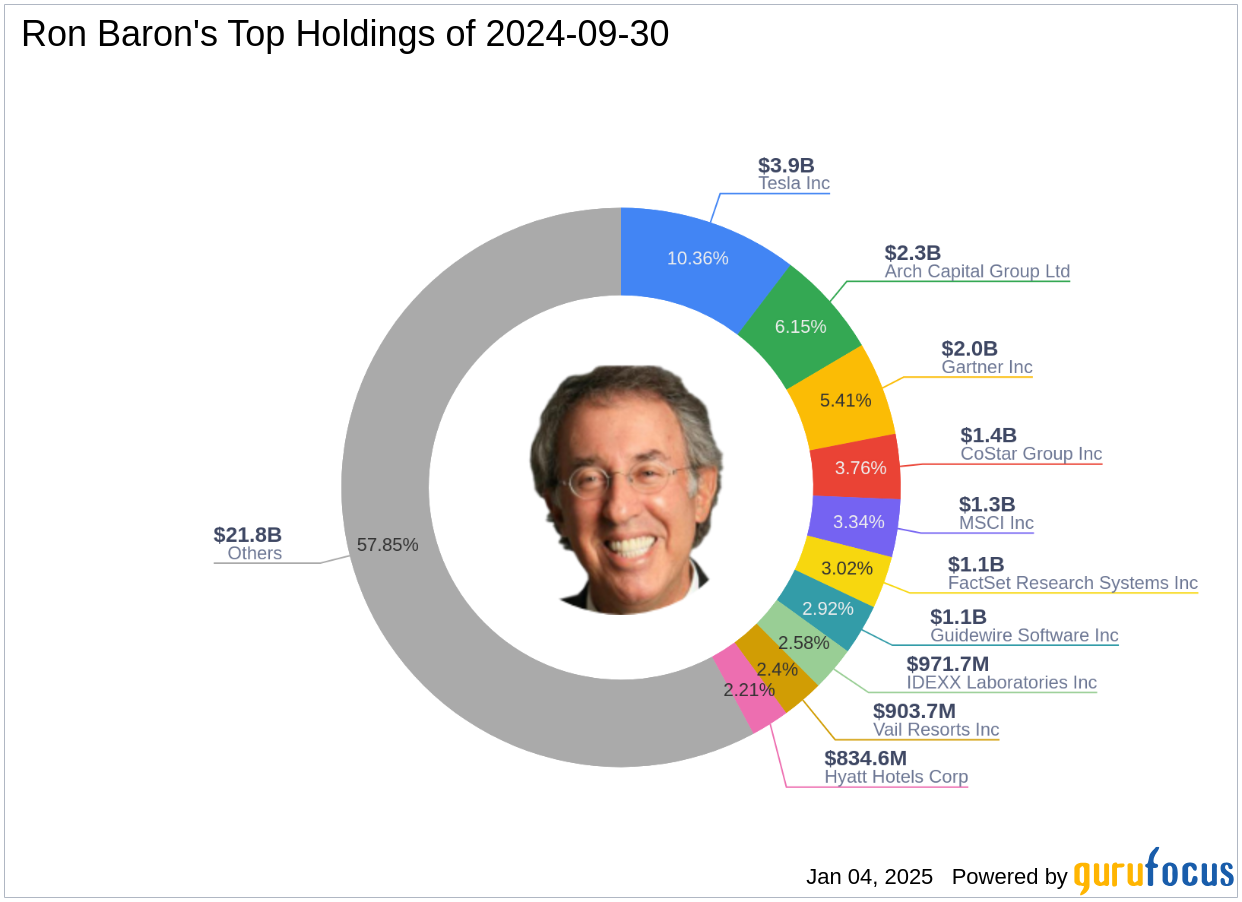

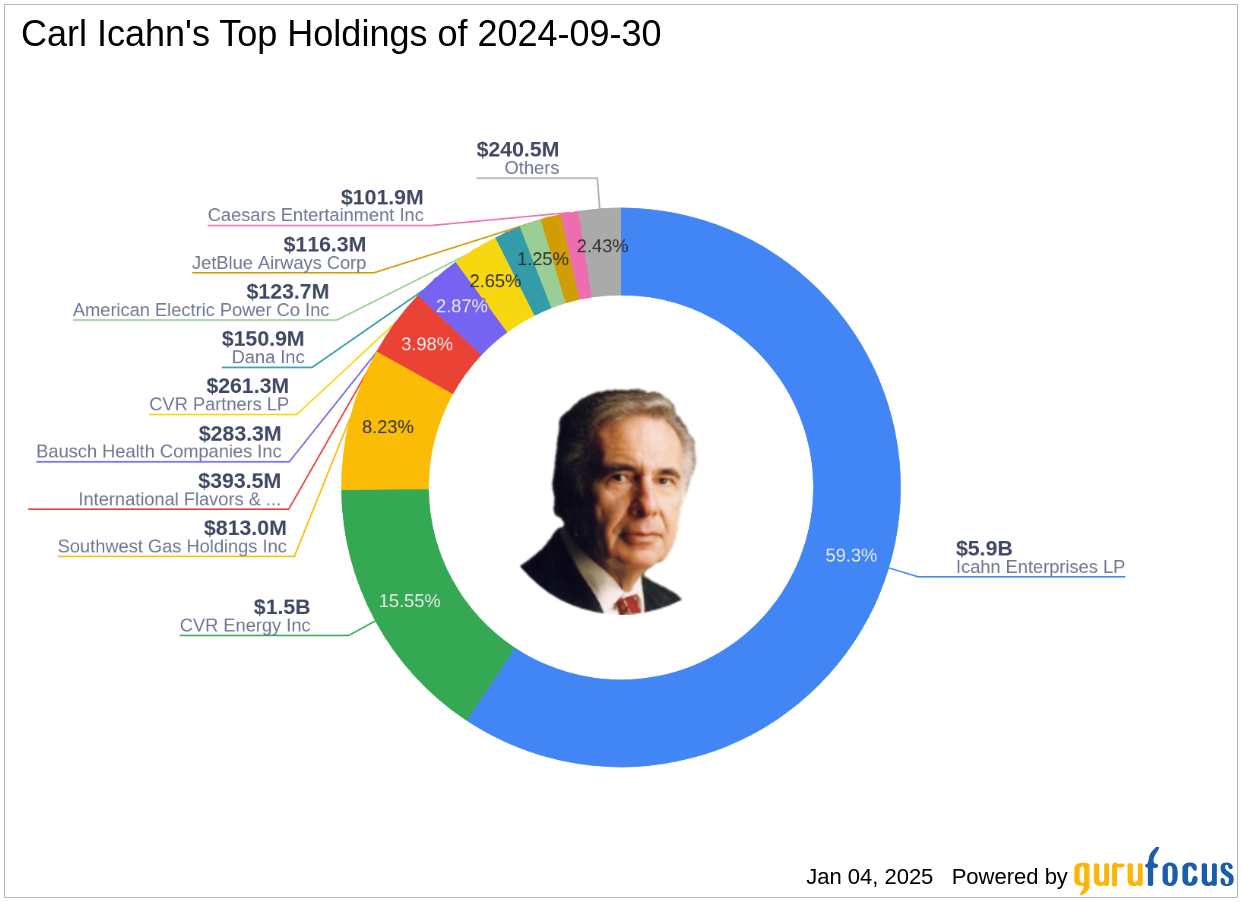

Guru Portfolio

Score Board

Mutual Funds

Top 10 Holdings

Sector Picks

International Picks

Aggregated Portfolio

Consensus Picks

Guru Bargains

Hot Picks

Download Guru Portfolios

Industry Trends

Geographic Trend

ETFs

Options Holdings

European Shorting

Buffett Indicator

U.S. Treasury Yield Curve

U.S. Inflation Rate

Presidential Cycle and Stock Market

Shiller P/E

Shiller P/E by Sectors

GF Value for S&P 500 Index

Fed Net Liquidity

Buffett Assets Allocation

Latest IPOs

Tools

Model Portfolios

All-In-One Screener

Data Batch Download

Guru Portfolio Download

Insider Data Download

Excel Add-In

Google Sheets Add-On

API

Manual of Stocks

DCF Calculator

WACC Calculator

Interactive Chart

Maps

Fund Letters Archive

Stock Comparison Table

Mobile App

Discussion Board

GuruGPT

Financial Calendar

Embed Widgets

Stock Market Holidays

Support